MARKET UPDATE CITY BY CITY

2024

This is a brief update of the market for 2024, based on current information on hand, and is naturally subject to many variables, such as interest rate rises, significant migration cutbacks or increases, inflation reigniting, an energy crisis, etc.

However, with the property market underpinned by the continuing shortage of new supply and migration, which sadly for renters and new first home buyers, will mean rents will not be falling anytime soon, and prices are highly unlikely to suffer any major falls even with a possible further interest rate increase 2024 before rates start to finally fall back down.

KEY TIPS:

1. Watch the migration figures for 2024 and 2025. The Government has long understated the figures, so as long as the official figures are over around 300,000 expect demand for housing to remain strong.

2. Rental vacancy rates. While vacancy rates remain below 2% assume continuing demand for rental property, investors to remain interested, and rent to rise. Watch the rental vacancy rates.

3. Watch the inflation rate. That will indicate when interest rates will start to come down, albeit slowly. That should trigger the next surge in demand. If you want to buy, buy before the rates start to come down.

INTEREST RATES KEY POINT:

Despite the historically fast interest rate rises over the past 2 years, they were coming from a very low base, but they remain NEGATIVE: that is the inflation rate is HIGHER than the cash interest rate, meaning those who are holding onto cash are losing money, which was a big part in the 2023 upturn.

MELBOURNE

After booming through 2020 and 2021 with prices rising by 15.8%, Melbourne housing values fell -7.9% from their peak in March 2022 through to January 2023, when prices started rising moderately, being up 3.5% for the 2023 year. x

Rents rose a massive 16.7% for the 12 months to November 2023. With the moderate rise in prices, and the huge rent rises, investors have seen rental yields increase, partly offsetting the interest rate rises.

Melbourne has now caught Sydney in terms of overall population, and depending on which source you read, may have overtaken Sydney.

In any event, Melbourne has a unique lifestyle and economic benefits that continues to attract overseas migrants, and currently there are plentiful jobs. Many are attracted to Melbourne for the lower house prices. Definitely not to be overlooked, in spite of the unpredictable weather (compared to Sydney).

Melbourne’s strong population growth and some large infrastructure spending will underpin Melbourne’s economic growth moving forward.

TIPS:

- 2024 could be a great time to buy in Melbourne before the interest rates start to fall.

- Avoid poor quality, mass produced apartments. These are going nowhere in terms of prices. And will be difficult to sell, even if you want to.

- Avoid "first home buyer" areas, mostly out west. Instead, look for the inner and middle ring suburbs for value, especially where there is little new supply, and good incomes.

For detailed MELBOURNE information go here.

SYDNEY

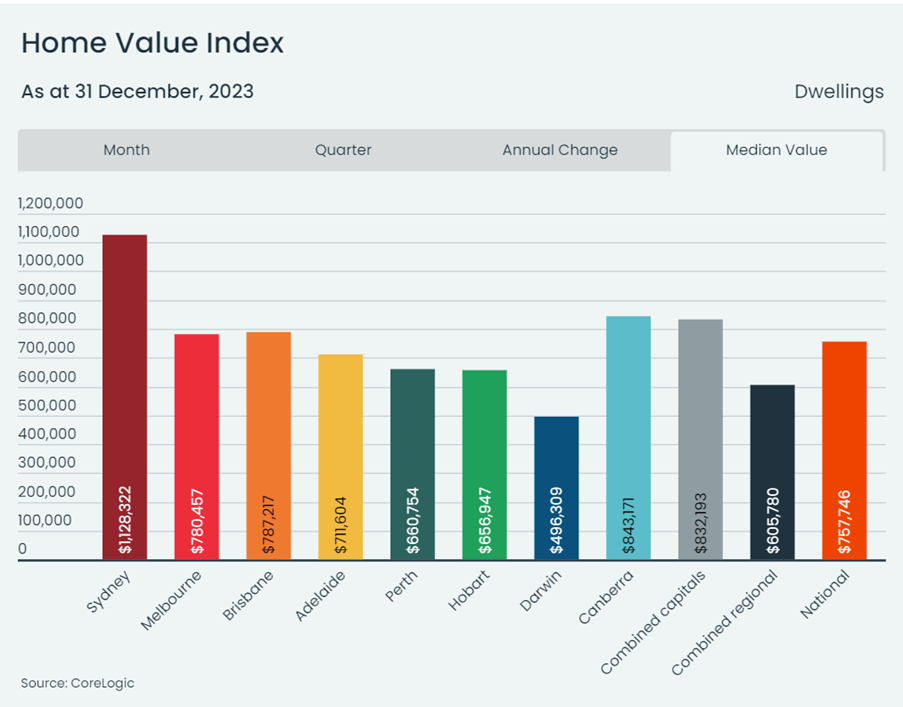

Sydney has everything going for it as a vibrant, fast growing dynamic city, and with that comes high property prices. After booming through 2020 and 2021 with prices rising by 27.2%, Sydney housing values fell -12.4% from their peak in January 2022, but the Sydney housing market clearly turned the corner in early 2023 with prices rising up by 11.1% since January 2023.

And there are no statistics that suggest that Sydney property values and rents will not keep rising in 2024, due strongly in part by the increase in population.

The city was reported to have had a 2% population growth rate in 2023 to reach 5.145 million. And despite 75,000 new migrants arriving Sydney has completed not more than 28,000 new dwellings over the year.

In saying that, if there is an economic slowdown, if unemployment reaches 5%, or if migration drops, we could see an overall downturn in Sydney prices. However, expect the top end of the market to keep rising strongly, and expect apartments to out perform (overall) houses due to the huge price differential.

TIPS:

-Look for property that appeals to owner occupiers not investors.

-Select areas that have performed well historically over the long term. These are likely to continue to do well.

-Select something that is different, or close to water, beach, parks, schools and transport.

-Apartment are expected to do well in Sydney. But like Melbourne, avoid standard cookie-cutter high rise buildings.

For detailed SYDNEY information go here

BRISBANE

Brisbane had an almighty boom from 2020, with prices rising by a massive 46.3% from Jan 2020 to May 2022.

Brisbane housing values then fell -8.9% from their peak in May 2022 until January 2023, but the Brisbane housing market has clearly turned the corner in early 2023 with prices rising consistently to now be up 13.1% since January 2023.

In fact in Brisbane, house prices in virtually all areas recorded rises of at least 8% to 12%, except the CBD.

And there are many signs that Brisbane will be one of the strongest housing markets again in 2024 with firm indications that Brisbane property values and rents will keep rising strongly in 2024 driven like Sydney and Melbourne by huge demand and shortage of supply.

TIPS:

- Look for Brisbane's best properties in the inner and middle-ring suburbs that are attractive to wealthy interstate arrivals form Sydney and Melbourne.

-Get something with land, either a house or a townhouse.

-Avoid all high rise new projects in the CBD.

For detailed BRISBANE information go here.

PERTH

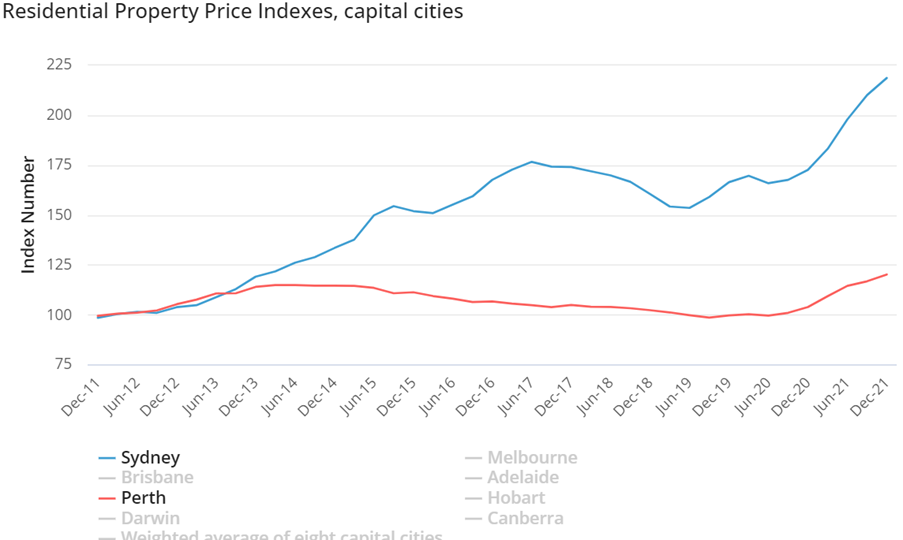

Ah Perth, what to say about Perth? After a long, long slowdown after the mining boom crash, house prices did not move for virtually 13 years. In fact, during the last mining boom there was a point when Perth was the most expensive city in Australia, briefly overtaking Sydney!

Look at the difference below!

In fact, Perth still has some of the most affordable prices of all the capital cities, in spite of a strong upturn over the past 2 years. The population is finally rising again, there remains a massive shortfall of new dwellings, demand is huge, and commodity prices are holding up.

TIPS:

- Perth is very reliant on commodity prices. Any commodities slump, worldwide recession etc always affects Perth population growth and employment.

-Perth is a very difficult market to understand and explain. If even vaguely thinking of buying, schedule a call to discuss. I do NOT have any properties to sell, buy am more than happy to share my own experiences buying in Perth. This was some of press coverage back in 2004. House prices boomed 88% in just 4 years from the date of this article to the highest point in March 2008!

- Look inner west and northern train line, within walking distance to the train line, and be relatively close to the beach.

-Definitely buy with land in Perth. Apartments are still far behind in terms of demand.

For more information on the current PERTH market go here