What the $1.0M Cap Means for Brisbane Buyers

A Boost for First Home Buyers

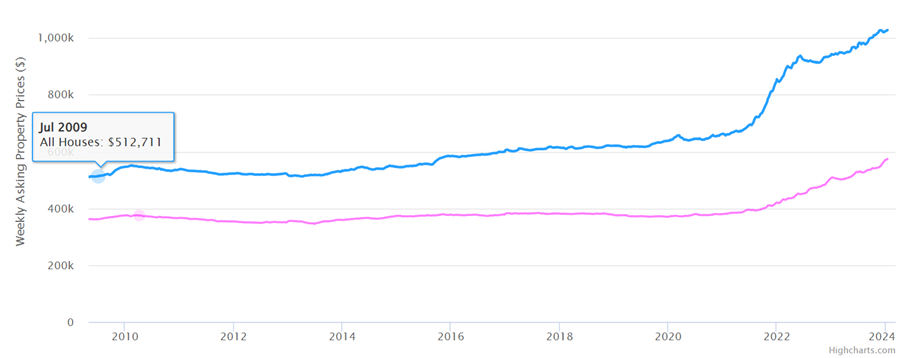

Brisbane has been one of Australia’s strongest-performing property markets in recent years, with house prices reaching record levels. The new $1.0M cap under the Home Guarantee Scheme gives first home buyers a much-needed edge, opening up a wider range of properties across the city and its high-demand inner suburbs.

From 1 October 2025, eligible buyers will be able to purchase with just a 5% deposit on properties up to $1.0M, with no cap on places. This removes the uncertainty of past years and gives first home buyers the confidence to enter the market with a clear plan.

Policy Meets a Cooling but Competitive Market

Brisbane’s market is showing signs of normalising after several years of outperformance. More properties have come onto the market recently, giving buyers more choice — but competition for well-located stock remains fierce.

The expanded scheme will:

-

Help bridge the deposit gap, particularly for buyers targeting inner and middle-ring suburbs

-

Remove the cost of Lenders Mortgage Insurance, freeing up savings for other purchase costs

-

Bring more buyers into the $800K–$1.0M range, potentially creating renewed competition at these price points

What This Means in Practice

With the higher price cap:

-

More houses and townhouses become accessible across popular suburbs like Wilston, Alderley, Camp Hill, and Tarragindi

-

Well-located three-bedroom townhouses and larger apartments in inner-city areas such as Newstead, West End, and Woolloongabba now fall within reach

-

Buyers who had been priced out can potentially enter the market years earlier thanks to the lower deposit requirement

Smart Strategy for Brisbane Buyers

Even with more listings available, Brisbane’s market remains highly competitive — particularly in desirable school catchments and lifestyle suburbs. To maximise your advantage:

-

Secure pre-approval so you can act fast when the right property comes up

-

Be suburb-specific – focus on areas with good infrastructure, transport links, and low vacancy rates

-

Complete your due diligence early – contract reviews, building inspections, and comparable sales data will help you buy with confidence

-

Be auction-ready – competition may still be strong at the $900K–$1.0M level, so set your budget and stick to it.

Challenges and Headwinds:

- Affordability Concerns: Stretched affordability, prompting buyers to opt for townhouses or apartments over homes, or choose more affordable suburbs.

- Unemployment Goals: The Reserve Bank of Australia (RBA) aiming to increase unemployment to curb inflation, creating financial uncertainty and impacting buyer decisions.

Market Trends:

- Differential in Property Types: Recent trends show houses outpacing apartments in value. The price gap between units and houses is at a record high. Family-friendly apartments in desirable neighborhoods are expected to experience strong capital growth.

While property price growth is expected to be lower compared to last year, there is a positive aspect: you have the opportunity to outperform the national market by strategically investing in the right property and location. By this, I don't mean simply targeting the next hotspot. Instead, focus on acquiring high-quality properties in areas with long-term potential, such as gentrifying suburbs.

Property investment provides numerous chances to enhance your outcomes through your time, skills, and knowledge, allowing you to surpass average returns. It's not just about location; you can also increase property value through refurbishment or redevelopment.

EXECUTIVE SUMMARY

There are many signs that Brisbane will be one of the strongest housing markets in 2026 with analysts and property experts pretty unanimous in the view that Brisbane property values and rents will keep rising.

However, it is my view that if Brisbane does have a good 2026, and rise even further ahead of Melbourne, then the slowdown (not crash) could again be prolonged.

When I say “again” it is because there was a long period (2010 to 2021) when Brisbane houses only grew by 1.62% pa. Units (apartments) fared even worse in this period.

I believe most analysts are too bullish on Brisbane in 2026 and beyond, and are too influenced by the feel good factor. The fear of missing out. The current booming market.

.jpg?timestamp=1706328201003)

It is my strong view, with nearly 40 years’ experience, that many of the analysts have been influenced by the euphoria of good data and positive trends.

Hosting the 2032 Olympics will ensure that Brisbane is put on the global map. Please remember one important fact. People think the Olympics will bring in tens of thousands of overseas visitors (true) who may fall in love with the city (also true) and may want to buy property (also true), but under current laws and regulations, they cannot buy properties, except for brand new and off the plan (see my CONCERNS below).

So, simply put, the Olympics will benefit current home and apartment owners by way of rents (make sure to have your property empty before the Olympics, as you can possibly get a years’ worth of rent in a month) and may attract new migrants as it has a unique lifestyle and plentiful jobs for highly paid knowledge workers. But, as they cannot buy property, it is unlikely to have any benefit on property prices.

The market is not easily explained. So if you are interested in either Buying or Selling in Brisbane, feel free to schedule a no obligation call for 45 minutes where we can go through in detail the market. Remember, I don't SELL houses (or apartments!) so there is no hidden agenda.

I provide advisory services to certain types of buyers and sellers, and am always happy to discuss the market with ANYONE as my business is very selective, doesn't suit most people, but relies on referrals from people just like you who I have helped without any obligation or commitment.

What does affect house prices is demand driven by population growth and shortage of supply, both of which Brisbane currently has. Federal government forecasts suggest that Queensland’s population is expected to grow by more than 16 per cent by the time Brisbane hosts the Olympic Games in 2032.

Thinking of Selling? Get my E-book below:

Home prices have now surpassed previous records.

You can always beat the averages.

Currently affordability constraints, including consecutive cash rate hikes and reduced borrowing capacity, combined with the perceived value units offer are all helping to steer buyer demand towards units.

This is creating a window of opportunity for homebuyers and property investors with a long-term perspective.

And when interest rates start to reverse and buyers will come back into the market with a vengeance. The time to position your self is before that happens.

Why is the market so strong, and what will happen next?

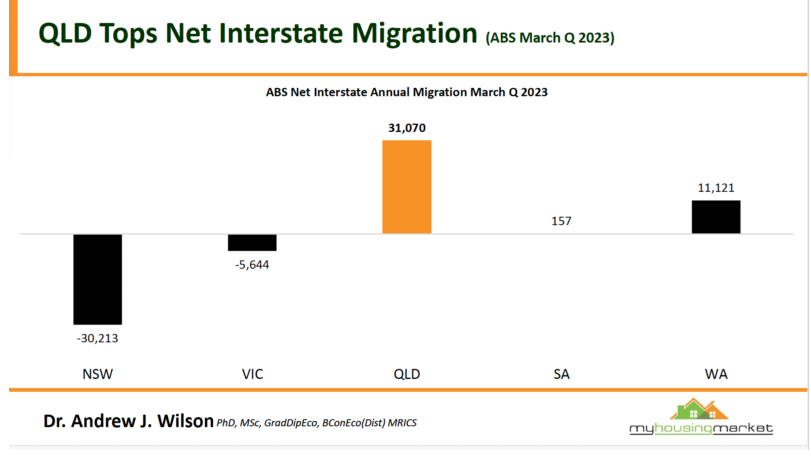

Well, there has been significant migration (nearly all northwards from Victoria and NSW) into Queensland with Australians dismayed by the Victorian lockdowns, and leaving expensive Sydney seeking more affordable property.

And therein lies the first clue as to what will happen next.

There is little logical reason why Brisbane prices should be higher or even match those of Melbourne.

Federal government forecasts in January 2023 suggest that Queensland’s population is expected to grow by more than 16 per cent by the time Brisbane hosts the Olympic Games in 2032.

And the population spread in Australia’s most decentralised state is tipped to sway towards the city, with most Queenslanders expected to live in Greater Brisbane by the time the Olympic flame is lit at the Gabba.

Greater Brisbane is expected to grow faster than the rest of Queensland, with a rate of 1.9 per cent projected for the capital in 2022-23, compared to 1.4 per cent for the rest of the state.

Growth was expected to slow slightly in 2032-33 to 1.3 per cent in Brisbane, compared to 1.2 per cent across the rest of Queensland.

As of 2021-22, most Queenslanders – 50.66 per cent – lived outside Brisbane, but the forecast growth rates were expected to result in 50.06 per cent of Queenslanders living in the capital by 2032-33.

Brisbane will be home to 3.082 million people, while 3.075 million were projected to live elsewhere in Queensland. And there is the second clue as to what happens next.

Brisbane house prices forecast: My view and Concerns

Digging deeper into the stats some properties have far outperformed others and freestanding Brisbane houses within 5-7 km of the CBD or in good school catchment zones have grown in value strongly.

It's really a tale of two cities - while some properties over perform, others underperform.

Recently Westpac Bank has said that by 2026 Brisbane would have gone through 6 years of spectacular real estate growth of over 45 per cent.

Brisbane’s property market trends

However, I still have reservations about Brisbane overall, that I outline under the headline CONCERNS below.

Townhouses in the same areas are also in huge demand, especially brand new, but there appears a shortage of these. Many are looking at townhouses as a more affordable option to a free standing house, anda s a preferred option to an apartment.

In recent years it has become clearer that apartments in Brisbane have missed out on the driving forces that have benefited houses. In much the same way as new migrants from places such as Hong Kong and Singapore always want to buy a house to live in, not an apartment, as they have likely lived in apartments all their lives. There argument is, and always has been, “why move to Australia and live in an apartment.”

The new ”migrants” to Brisbane have come from Melbourne and especially Sydney.

Their reasoning has been similar to the overseas migrants: “why move to Brisbane to live in an apartment.”

And here is the the third concern.

To many, liveability will mean a combination of:

- Proximity – to things like parks, shops, amenities, and good schools

- Mobility – access to good public transport (even though this may be less important moving forward) or a good road system

- Access to jobs

The bottom line is that for those with a secure job and who have their finances under control, now is still a great time to buy into the Brisbane housing market.

Currently, due to a short supply of A-grade homes and investment-grade properties, and a surplus of buyers, the quality property is a seller's market where asking prices could just keep rising.

Not only have certain locations grown in value, but Brisbane has also seen a distinct outperformance of house values relative to units.

Brisbane housing market drivers

There were multiple factors that contributed to the demand surge seen across its property markets, Queensland is unique in that its housing markets are being boosted by soaring interstate migration with many Aussies migrating north (mostly out of NSW and Victoria) in search of lifestyle suburbs as well as getting it's fair share of international migrants.

Affordability is another key driver.

Another appeal of housing markets across Brisbane and the rest of Queensland is that values remain relatively low, particularly relative to the housing values across the other east coast cities of Canberra, Melbourne, and Sydney.

And it is likely Brisbane's more affordable house prices and great lifestyle will keep attracting both interstate and overseas migration.

MY concerns...

It's likely that some of the high-rise apartment towers in and around Brisbane’s CBD, which were already suffering from the adverse publicity of structural problems prior to Covid-19, will now become the INVESTMENT DISASTER as they are shunned by homeowners and investors.

Brisbane's median house value sitting at just 63% of Sydney's suggests a powerful blend of growth and affordability, making the city an attractive option for investors.

Like Australia's other large capitals, the more expensive properties in Brisbane are outperforming middle and lower-price properties with regard to capital growth.

Moving forward, houses in Brisbane’s inner and middle-ring suburbs offer the best prospects of long-term capital growth as this is where there are more skill level 1 workers - those who earn higher incomes, often having multiple sources of income.

The fact is, the rich are getting richer and they are able to and prepared to pay more for their homes.

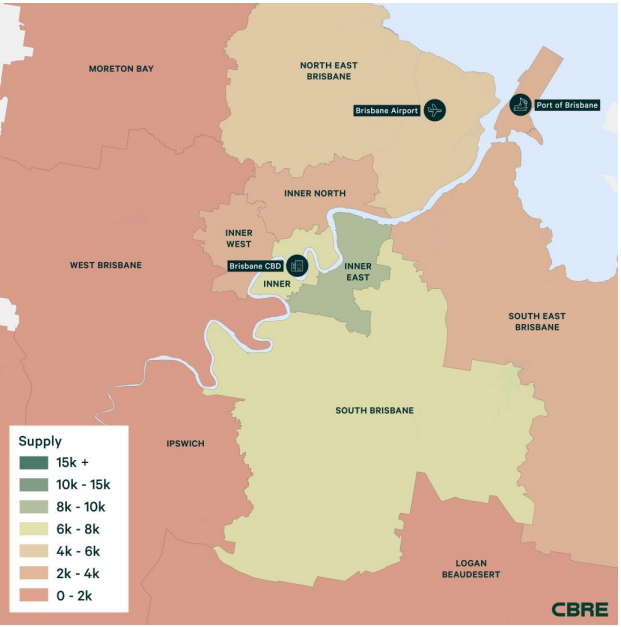

BRISBANE APARTMENT MARKET OVERVIEW

Apartment living in Brisbane came late to the party compared to Sydney and Melbourne and, in general, houses make better long-term investments than apartments in Brisbane.

But now there is a mismatch between demand and supply.

CBRE estimates Brisbane's apartment delivery will average 6,500 pa over 2024-28.

Demand for apartment stock is likely to average 16,500 pa over the next 5 years.

Is it the right time to invest in Brisbane's property?

Buyers and sellers are beginning to realise that inflation is under control and that interest rates have most likely peaked and they are stepping back into the market.

Of course, the Brisbane housing market won't boom again like it did in 2020-21 any time soon.

The market is not easily explained. So if you are interested in either Buying or Selling in Brisbane, feel free to schedule a no obligation call for 45 minutes where we can go through in detail the market. Remember, I don't SELL houses (or apartments!) so there is no hidden agenda.

I provide advisory services to certain types of buyers and sellers, and am always happy to discuss the market with ANYONE as my business is very selective, doesn't suit most people, but relies on referrals from people just like you who I have helped without any obligation or commitment.

Property markets move up and down cyclically and while the short-term trends may be flat or downwards, the long-term trend has been up.

But while overall our economy is performing soundly, consumer sentiment – both fear and greed – tends to drive the property markets, and at the moment both buyer and seller confidence is fragile in the face of all the negative media.

This means that many discretionary Brisbane home buyers and sellers are just sitting on the sidelines.

On the other hand, strategic investors and home buyers with a long-term view are taking advantage of this window of opportunity which will close when the average home buyer and investor realise that the Brisbane housing market bottomed in the first quarter on 2023.

But few A-grade homes are currently on the market leaving property buyers with little choice.

At the same time, Queensland is currently the fastest-growing state in Australia driven particularly by interstate migration.

And the demand for lifestyle areas and extremely strong demand for detached houses in Brisbane, particularly in the inner and middle-ring suburbs, will underpin property values.

-

Apart from Location – Location – Location is there ANOTHER Golden Rule of Property Investing in Australia?

YES there is. It is the QUALITY of your property that is of major importance to it’s financial success going forward to 2028.

KEY POINTS

- The quality of the property determines long-term investment returns.

- Average-quality property yields average returns; above-average quality leads to above-average returns.

- Combined with strategic locations near the water, city hubs, parks, shops, schools and supermarkets, helps ensure investment success. Wherever possible, focus in inner and middle ring properties ONLY.

- Focused Investment Energy:

- Direct energy towards asset quality working with your professional property buyers agent.

- Outsource all other matters (tax, borrowing, property management, building inspections etc.) to advisors.

- Attributes of Quality Property:

- Sustained buyer demand exceeding supply.

- Appreciating value/prices in the long run.

- High-quality property is scarce.

- Factors Impacting Supply and Demand:

- In prime investment locations, supply is fixed or diminishing.

- Supply includes land supply and dwelling type/style.

- Land Supply Dynamics:

- Well-established, blue-chip suburbs have fixed and finite land supply.

- Outer suburbs may have abundant land supply due to releases within a 20km radius.

- Property Type and Style Effect on Supply:

- High-land-value locations see stable house supply; apartments can change more readily.

- Example: Victorian style houses have finite supply, potentially diminishing.

- Buyer Demand Exceeding Supply:

- Buyer demand refers to potential buyers desiring property in a certain location.

- Demand substantially exceeding supply leads to rising property prices.

- Imbalance in Supply and Demand:

- Invest where buyer demand substantially exceeds supply.

- Notionally, 10 buyers for every seller ensures price stability despite changes in supply or demand.

- Long-Term Price Support:

- Despite changes, the number of buyers exceeds sellers, supporting prices.

- Prices remain resilient even during supply increases or demand reductions.

Tips:

Location Matters:

Look for properties in inner and middle-ring suburbs.

Proximity to City Centre:

Suburbs close to the city centre tend to perform better over the long term. Avoid CBD apartments.

Value Appreciation Factors:

Properties closer to the CBD, the University, Brisbane River, and bayside areas will experience faster value appreciation.

Research Confirmation:

Research confirms that suburbs near the CBD, with high demand, employment opportunities, and limited available land, outperform outer suburbs.

Supported by research from the Australian Housing and Urban Research Institute.

Gentrification Impact:

Gentrification has significantly influenced property values in inner- and middle-ring suburbs.

Demographic Shifts:

Gentrification resulted from demographic changes, not deliberate planning policies.

Exodus of industry, migrants, and workers paved the way for gentrification in inner suburbs.

Changing Demographics:

Changing demographics, including declining household size, contributed to the appeal of small inner suburban dwellings.

Ideal accommodation for professionals working in or near the CBD.

Attractions for Gentrifiers:

Gentrifiers initially attracted by job diversity, educational opportunities, and lifestyles in inner suburbs.

Trend continues as Australians increasingly opt for urban living over traditional suburban homes in the outskirts.

Property investor activity has been strong, particularly for houses, not only coming from locals but from interstate investors who see strong upside in Brisbane property prices as well as favourable rental returns.

But be careful…

Note: Like every city in Australia, there is not one Brisbane property market, nor one south-east Queensland property market, and different locations are performing differently and are likely to continue to do so.

Houses and townhouses remain a firm favourite of prospective home hunters, however, apartment demand has been picking up too but, in general, apartments in Queensland are a higher risk investment than houses, particularly due to the fact that many apartments are unsuitable for families or owner-occupiers.

However with rising building costs, new apartments are going to cost developers a lot more to get out of the ground and therefore eventually cost more in the marketplace which means there is intrinsic equity in established Brisbane apartments and townhouses.

At the same time, affordability issues will push what would have been a buyer of a detached home back into the unit market.

Whether a house, townhouse or unit (apartment) secure the services of an experienced buyers agent to represent you against the selling agents to avoid over paying, or buying the wrong property. Use their research capabilities to choose the correct location.