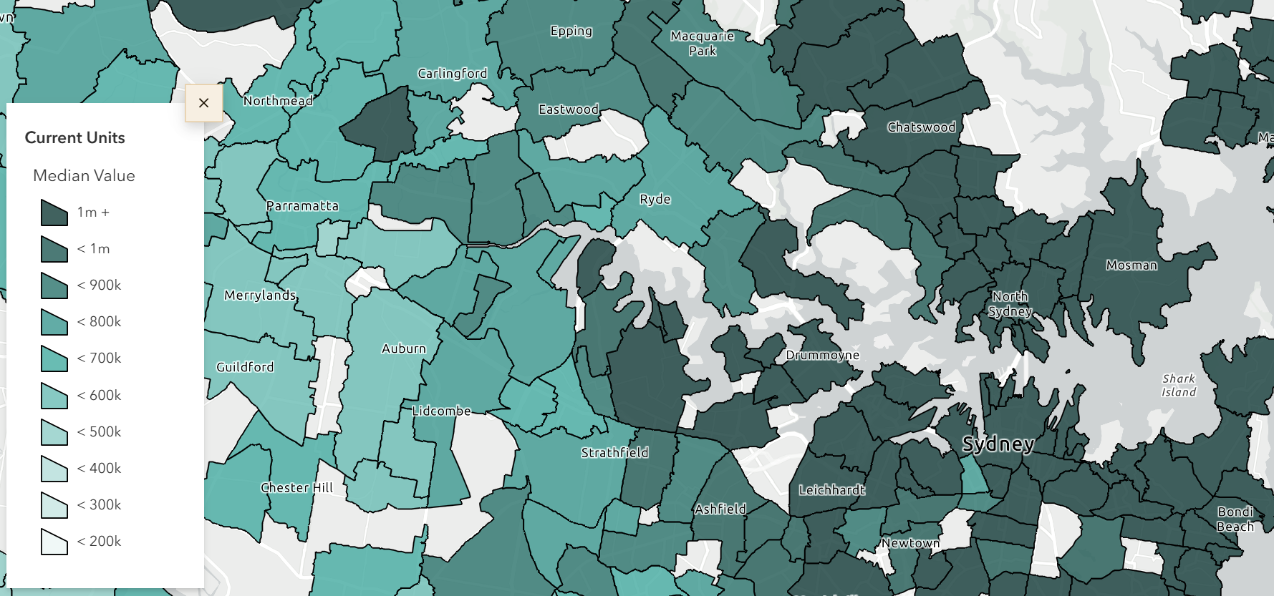

Where to Buy Sydney Apartments for Investment?

Many suburbs qualify for the new 5% Deposit Scheme, and the "ripple effect" is highly likely to be seen in 2026-2028

As can be seen there remains some very affordable pockets for investment in Sydney. Mike Bentley offers 6 key principles to follow when investing in apartments.

Source: Cotality November 2025

Get Clarity on Your Apartment Buying Strategy — Free 45-Minute Session

If you found this information helpful, you’ll love what we can cover in a personal briefing:

✓ The 6 key apartment buying essentials elements

✓ Your budget

✓ Your best suburbs

✓ Your buying strategy

✓ What to avoid

✓ What to focus on

👉 Book Your Free Strategy Session

The Federal Government has fast-tracked its expanded Home Guarantee Scheme from January 2026 to October 1, 2025, enabling buyers to purchase with just a 5% deposit.

The maximum purchase price in Sydney for this scheme is set at $1.5 million.

This follows the third interest rate cut for the year in August. These cuts mark a significant shift for borrowers, as the RBA had previously increased rates 13 times between May 2022 and November 2023.

While this is very good news for today’s first-home buyers, it is not so good news for future buyers as it is a policy that will drive up property prices in the short term.

History shows that similar grants and incentives – from the First Home Owners Grant to COVID buyer support – simply fuelled further price growth rather than improved affordability.

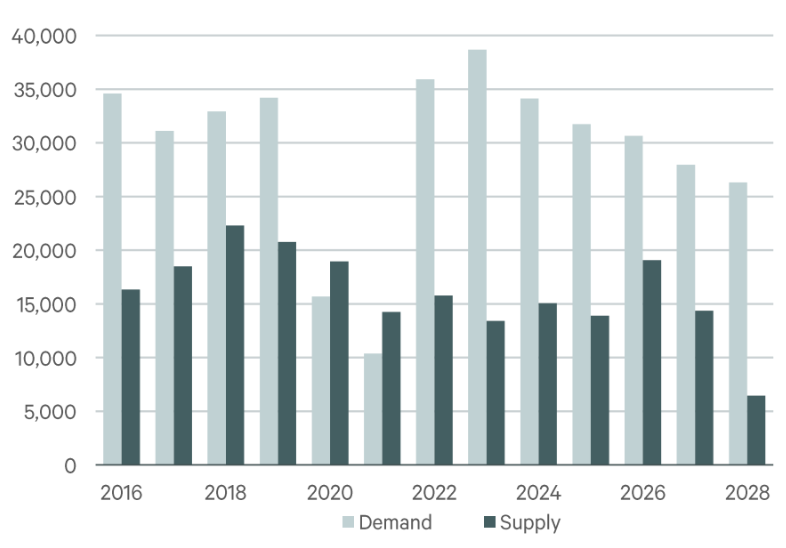

The under supply of properties is going to persist for many years to come.

What the $1.5M Cap Means for Sydney Buyers

A Game-Changer for First Home Buyers

The new $1.5 million price cap in Sydney finally aligns the Home Guarantee Scheme with real-world market prices for many well-located middle-ring and even inner-ring apartments and townhomes.

This change opens the door for more first home buyers with stable incomes but smaller deposits. From 1 October 2025, eligible buyers can secure finance with just a 5% deposit on properties up to $1.5M — a significant jump from the previous $900K limit.

With Housing Australia confirming that places are now uncapped, buyers and lenders can plan with greater confidence for the busy pre-Christmas market — and into 2026.

Policy Meets Market Reality

The expanded scheme is designed to:

Remove barriers caused by large deposit requirements

Avoid costly Lenders Mortgage Insurance

Bring more buyers into the market at price points up to $1.5M

However, Sydney’s low vacancy rates and limited new supply mean that demand could place additional upward pressure on prices, particularly in popular areas like the Inner West.

This is great news for long-term capital growth, but it also means competition for quality stock could intensify.

What This Means in Practice

For eligible buyers:

-More suburbs are now within reach – including many inner-ring locations previously excluded by the old cap

-Faster timelines – the lower deposit requirement may bring forward your purchase by years

-Lower upfront costs – no Lenders Mortgage Insurance means more of your savings go directly towards your property

-With limited house supply under $2M we expect many buyers to focus on high-quality apartments and townhouses priced between $1.2M and $1.5M to maximise location and lifestyle benefits.

Smart Strategy for Sydney Buyers

From October, demand is likely to lift quickly — so:

- Get your loan pre-approved early to act decisively when the right property appears

- Do your due diligence – building and strata reports, contract reviews, and price comparisons remain essential

- Set clear search parameters – avoid being caught in a bidding frenzy that pushes you above your budget

- Hire experts to assist - Remember, the guarantee removes Lenders Mortgage Insurance but does not replace prudent borrowing checks. Maintaining affordability, serviceability buffers, and a disciplined approach will be key.

- Get your team of experts in place as the market will be competitive. Get your buyers agent, solicitor, and building inspectors ready.

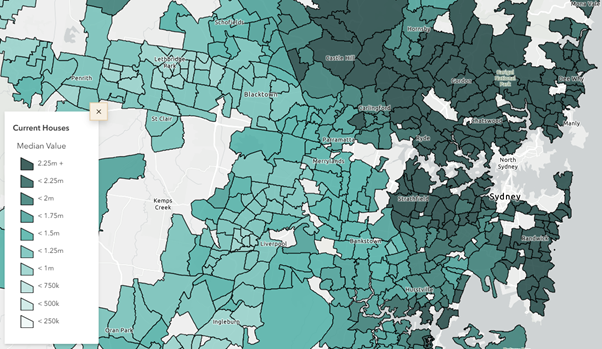

WHERE IN SYDNEY THAT QUALIFIES FOR THIS CAP?

HOUSES:

As can be seen above, the outer areas offer plenty of opportunities for home buyers in this price range.

The inner areas are now well above this level, so if seeking an investment, or a more affordable property, apartments offer more choice.

Currently, there are 5.2 million people in Sydney. By mid-century Sydney will have 8 million people and NSW will have 10 million inhabitants.

Sydney has a unique lifestyle and economic benefits that will continue to attract overseas migrants (in spite of the high prices) as well as plentiful jobs for highly paid knowledge workers. After all, who wouldn't want to live in Sydney if you can afford it.

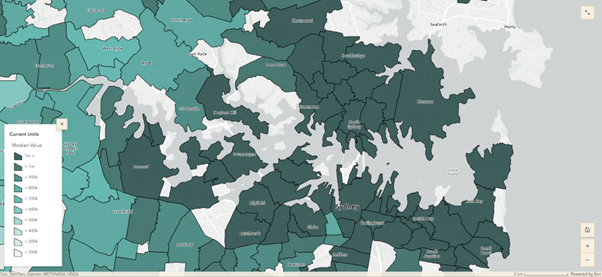

UNITS (APARTMENTS):

Sydney was the first Australian capital city to embrace apartment living more than 30 years ago, with the most recent Census showing that 20.7% of all the dwellings in Sydney being apartments and in fact 47% of all the apartments in Australia are in Sydney.

The Mapping above shows most apartments in Sydney remain BELOW the $1.5M fist home buyers threshold, with the inner suburb of Ultimo being the only area in light green, with a median apartment price of just $702,000.

This is a standout signal to buy in this area, as adjoining and close by areas such as Waterloo ($987,000), Camperdown ($913,000) and Newtown ($880,0000) are significantly more.

On the North Shore, West Ryde ($687,000) and Gladesville ($812,000) stand out, while the 'blue-chip' suburbs of Neutral bay, Mosman Bay, Kurraba Point, North Sydney and Cremorne Point are ALL just below that critical $1.5 M figure.

It can safely be assumed that these areas will be preferred and targeted by first home buyers looking to take advantage of the 5% deposit scheme, pushing all these suburbs over that figure is the short term.

My apartment buyers service can help you secure an apartment in any of these areas quickly and safely, and even off market, at a fee of around 1.5% of the price.

(If you would like a Mapping Chart like these for any specific suburbs and the adjoining areas just email me at michael@citylifeproperty.com, and I will happily provide it for you. It is a very easy and clear way to see what values are in adjoining suburbs, to either pin-point undervalued suburbs or take advantage of the "ripple-effect" that I have spoken about many times)

How I Can Help

If you’re considering buying an apartment I can help you:

- Identify suburbs and properties within the $1.5M cap

- Conduct due diligence and avoid common pitfalls

- Negotiate confidently in a competitive market

- Secure an off-market property before it reaches the general public

📞 Reach out for a no-obligation discussion — I’ll help you plan your strategy and be ready to act when the right property comes along.

Well-located, family-friendly apartments in Sydney's inner suburbs are certain to continue to perform strongly due to increasing demand from owner-occupiers (particularly First Home Buyers) and investors.

And at the same time, average or poor quality apartments in high-rise towers will continue to languish.

SYDNEY APARTMENT SUPPLY 2016-2028:

Ready to Help

Whether you are a foreign investors, and Australian living overseas, first-time buyer, looking to upgrade or downsize, I am here to help.

To find out more about my apartment buying services please book a call with me. I love chatting about real estate, and look forward to out conversation!

I Have No Properties to Sell

My professional service may, or may not, suit your requirements. I work in only selected areas where I am an expert, and where I have the right connections.

- I will work with you to understand your needs and set a detailed brief. We then start the search process including reaching out to my vast network of agents and owners to uncover suitable opportunities, especially off-market opportunities.

- We shortlist and present the best on and off-market properties matching your brief.

- We organise our due diligence process to ensure that all properties of interest have been thoroughly vetted before being short-listed for your purchase consideration.

- We undertake comprehensive pricing research to narrow down the true value and growth potential of a property so that you can proceed with confidence or know when to walk away.

- We negotiate the lowest price and best terms using our honed skills and proven strategies.

There is no limit on options presented. We will keep searching and presenting opportunities until successful purchase.