Where to Buy Melbourne Apartments for Investment?

Many suburbs qualify for the new 5% Deposit Scheme, and the "ripple effect" is highly likely to be seen in the future

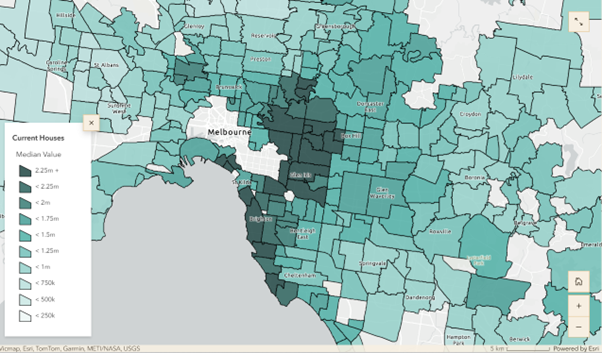

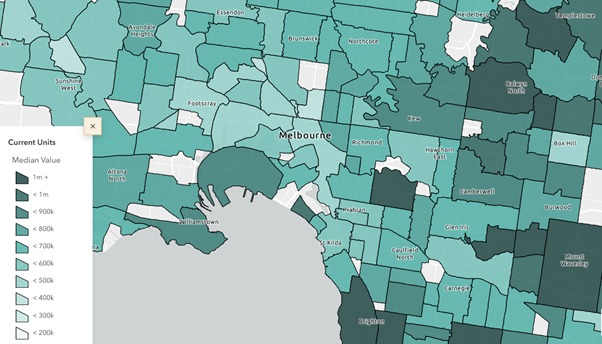

As can be seen there are some very affordable pockets for investment in Melbourne. Mike Bentley offers 6 key principles to follow when investing in apartments.

Source: Cotality November 2025

Want personalised apartment advice?

Book your free, no obligation 45-minute briefing.

One-on-one guidance from a 30-year apartment specialist.

👉 Book Your Free Briefing

The Federal Government has fast-tracked its expanded Home Guarantee Scheme from January 2026 to October 1, 2025, enabling buyers to purchase with just a 5% deposit.

The maximum purchase price in Melbourne for this scheme is set at $950K.

This follows the third interest rate cut for the year in August, 2025. These cuts mark a significant shift for borrowers, as the RBA had previously increased rates 13 times between May 2022 and November 2023.

-

While this is very good news for today’s first-home buyers, it is not so good news for future buyers as it is a policy that will drive up property prices in the short term.

-

History shows that similar grants and incentives – from the First Home Owners Grant to COVID buyer support – simply fuelled further price growth rather than improved affordability.

-

The under supply of properties is going to persist for many years to come.

Why the $950K Cap Will Reshape Melbourne’s Market

Urgency Fuels the Market

If this feels familiar, it’s because we’ve seen it before. During COVID, stamp duty concessions lit a fire under the market, with buyers pushing bids up by as little as a cent just to stay under the magic threshold.

The $950k cap is shaping up to do the same — urgency is back, and buyers won’t want to miss out. Combined with Melbourne being one of the more realistically priced house markets in the country, and with Victoria welcoming 120,000 new migrants last year, but only building around 60,000 new homes.

The math doesn’t lie: more people, more demand, more buyers now able to enter the market and fewer properties — and you’ve got a recipe for higher prices.

Where the Pressure Lands

So who really feels the heat when the cap shifts from $800k to $950k?

-

Not family homes in Camberwell or Hawthorn. $950k won’t buy you a backyard there.

-

But small villa style homes in blue-chip pockets? That’s where the storm hits.

Find a neat single-level small homes in these suburbs and they about to jump. Fast. Overnight gains of $50,000++ won’t be surprising.

Further out, Bayside suburbs like Carrum are also in the firing line. With properties still hovering around $950k, expect competition to surge.

What It Means for Buyers and Sellers

This isn’t a free pass. Competition at or below $950k will intensify, and properties in that range will get snapped up quicker than ever. While first-home buyers benefit, the government still pockets millions in stamp duty.

For buyers, it means moving fast and being finance-ready. For sellers with properties under $950k, it could be the best window in years in Melbourne. And for sellers of apartments, at last demand might pick up.

WHERE IN MELBOURNE QUALIFIES FOR THIS CAP?

(PRO TIP: Buy in these suburbs)

HOUSES:

In direct contrast to Sydney, Melbourne has many suburbs that qualify for the $950K threshold. However, as can be seen they are are all in the outer suburbs, just like Sydney.

APARTMENTS

The difference in Melbourne apartments with Sydney is truly startling. Most suburbs , even prime blue chip ones, qualify for the under $950,000 cap in Melbourne.

(If you would like a Mapping Chart like these for any specific suburbs and the adjoining areas just email me at michael@citylifeproperty.com, and I will happily provide it for you. It is a very easy and clear way to see what values are in adjoining suburbs, to either pin-point undervalued suburbs or take advantage of the "ripple-effect" that I have spoken about many times)

A Game-Changer for First Home Buyers

The new $950K million price cap in Melbourne finally aligns the Home Guarantee Scheme with real-world market prices for many well-located middle-ring and even inner-ring apartments and townhomes.

This change opens the door for more first home buyers with stable incomes but smaller deposits. From 1 October 2025, eligible buyers can secure finance with just a 5% deposit on properties up to $950K — a significant jump from the previous limit.

With Housing Australia confirming that places are now uncapped, buyers and lenders can plan with greater confidence for the busy pre-Christmas market — and into 2026.

Policy Meets Market Reality

The expanded scheme is designed to:

-

Remove barriers caused by large deposit requirements

-

Avoid costly Lenders Mortgage Insurance

-

Bring more buyers into the market at price points up to $1.5M

What This Means in Practice

For eligible buyers:

-

More suburbs are now within reach – including many inner-ring locations previously excluded by the old cap

-

Faster timelines – the lower deposit requirement may bring forward your purchase by years

-

Lower upfront costs – no Lenders Mortgage Insurance means more of your savings go directly towards your property

With limited house supply under $950K in Melbourne in closer in areas, we expect a flood of buyers to focus on high-quality apartments and townhouses to maximise location and lifestyle benefits.

While apartments in Melbourne are undervalued, careful selection remains critical to maximise the forthcoming upturn.

Smart Strategy for Melbourne Buyers

From October, demand is likely to lift quickly — so:

-

Get your loan pre-approved now to act decisively when the right property appears

-

Do your due diligence – building and strata reports, contract reviews, and price comparisons remain essential

-

Set clear search parameters – avoid being caught in a bidding frenzy that pushes you above your budget

- Consider locking in to an apartment at 2015 prices with 7 to 85 rent return. We have not seen this for decades. They will be big beneficiaries of this 5% deposit scheme and cap

- Hire experts to assist - put your team in place, the market will be tough! Select your buyers agent, solicitor and building inspector early.

Remember, the guarantee removes Lenders Mortgage Insurance but does not replace prudent borrowing checks. Maintaining affordability, serviceability buffers, and a disciplined approach will be key.

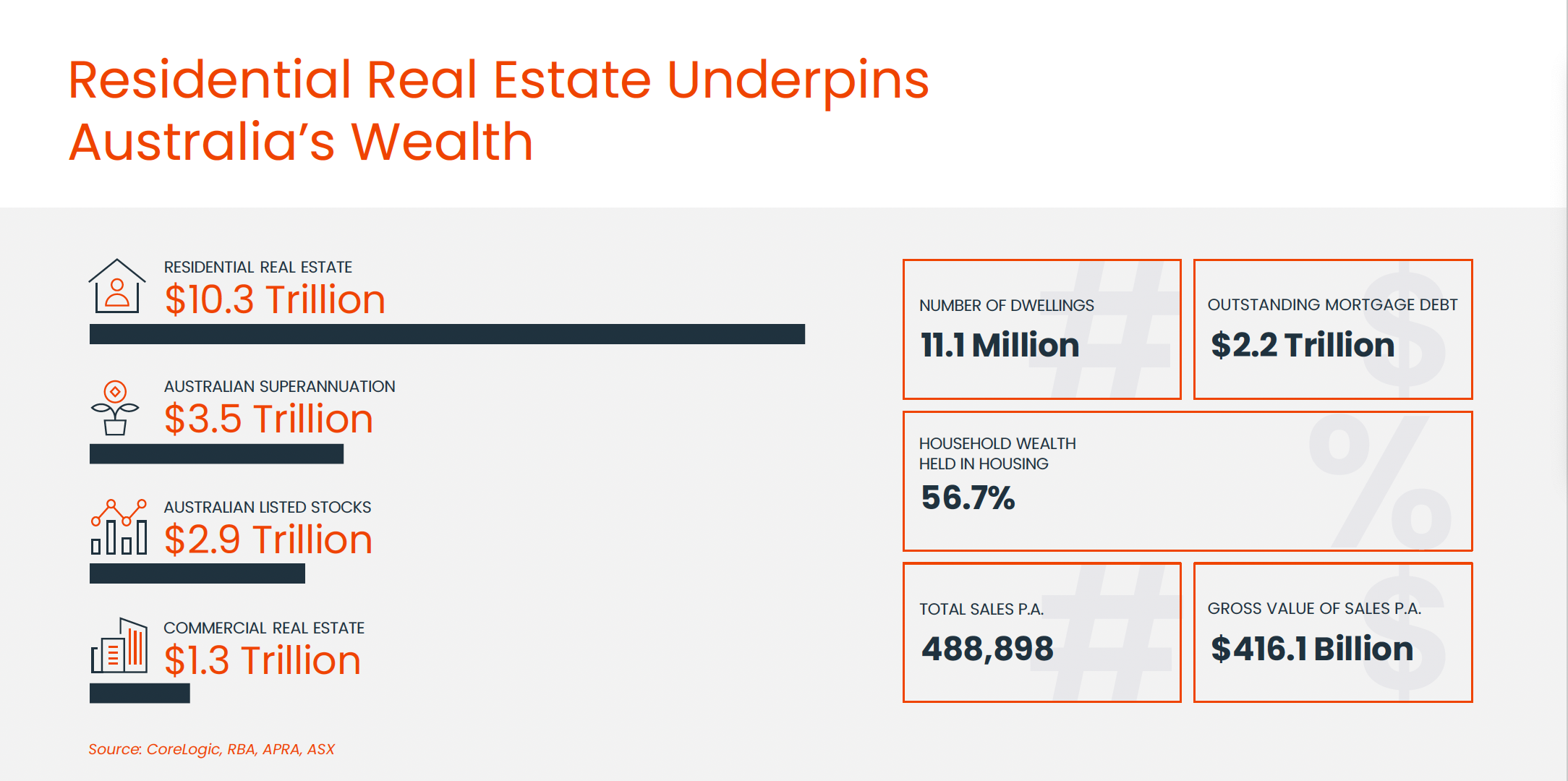

Sydney was the first Australian capital city to embrace apartment living more than 30 years ago, with the most recent Census showing that 20.7% of all the dwellings in Sydney being apartments and in fact 47% of all the apartments in Australia are in Sydney. Melbourne remains a long way behind Sydney.

Perhaps Melbourne apartments are the Sydney apartments of 20 years ago?

How My Apartment Buyers Service Can Help You

Buying an apartment — especially in a changing market — can feel overwhelming. That’s where an experienced buyers’ agent makes a real difference.

I give you real-time suburb insights, so you know which buildings and locations are in demand, where listing numbers are tight, and where real value still exists. I also uncover off-market opportunities you won’t find online — giving you a head start before the wider market even knows they’re available.

When you’re ready to act, I provide clear price modelling based on recent sales and help you position yourself before auction to secure the right property at the right price. Beyond the numbers, I manage the detail — building checks, strata reviews, and contract risks — so you can buy with confidence, knowing there are no nasty surprises later.

In short, I represent your interests from start to finish, helping you buy the right apartment, at the right price, with less stress and more certainty — even when competition heats up.

Let’s Have a Chat

If you’re thinking about buying an apartment — now or in the future — I’d be happy to share my insights and answer your questions. There’s no obligation and no hard sell, just practical advice to help you make well-informed decisions.

Melbourne’s apartment market is still undervalued — which means smart buyers can secure excellent long-term value before prices fully recover.

I work with buyers to:

-

Identify the right suburbs and dwelling types within your budget

-

Negotiate effectively and avoid overpaying

-

Provide peace of mind with due diligence and contract reviews

Reach out for a no-obligation discussion — I can help you prepare a clear strategy so you’re ready to act decisively when the right property appears.

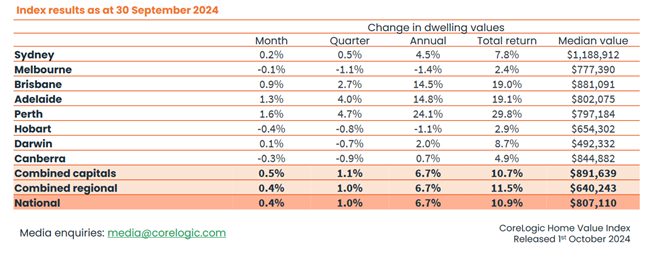

UPDATE Q4, 2024

As Australia’s property markets fluctuate in response to economic forces, one city stands out with significant potential for a comeback: Melbourne. Despite recent challenges, Melbourne could be poised for strong growth in 2025 and beyond, offering a unique opportunity for investors willing to think long term.

While high interest rates and property taxes are causing concern among investors, the fundamentals of Melbourne’s market suggest that it may be on the verge of a countercyclical upswing.

Here’s why Melbourne may outperform other Australian property markets going forward 2026-2028.

Melbourne’s Strong History of Price Growth

Melbourne has a long track record of strong property price growth, which provides a solid foundation for future performance. Historically, Melbourne’s property values have shown resilience, bouncing back from market slowdowns and external shocks.

Over the past few decades, it has been one of the fastest-growing property markets in Australia, driven by a diverse economy, high levels of immigration, and its appeal as a cultural hub.

While Sydney has always been the most expensive city, Melbourne has always held second place, until 2024.

The strength of its long-term performance makes it a market worth watching closely, especially as the current period of underperformance may be creating an attractive entry point for investors.

Why Melbourne Has Under Performed

Several factors help to top explain why Melbourne has underperformed, but these are largely temporary challenges that are expected to resolve over time. Melbourne’s housing market has faced a series of unique pressures that have caused it to struggle more than other Australian cities, such as Sydney and Brisbane.

FIRSTLY, Melbourne was hit harder by the extended COVID-19 lockdowns, which not only affected the local economy but also slowed population growth. While interstate and international migration were key drivers of demand pre-pandemic, border closures significantly reduced the number of new residents coming into Melbourne. This had a direct impact on housing demand, especially for apartments and inner-city dwellings.

SECONDLY, the cost of living pressures, including rising interest rates and property taxes, have been more pronounced in Melbourne. The Victorian state government introduced additional taxes, particularly aimed at higher-end properties and foreign investors, as part of their budget recovery efforts. This has made investing in Melbourne property slightly less attractive in the short term for both local and international buyers.

LASTLY, sentiment around Melbourne’s property market has been somewhat negative due to these factors. Many investors have become cautious, waiting for signs of recovery before making significant investments. However, history shows that periods of under performance can present the best opportunities for future gains.

Indicators of the Next Upturn

Despite these challenges, there are several signs that Melbourne’s property market could be on the cusp of a significant upturn. Investors who are willing to look beyond the short-term uncertainty and focus on the long-term fundamentals will likely benefit from Melbourne’s next growth phase. And for the first time in over a decade, we can confidently says it is NOT just houses, but apartments too that will (finally) rebound.

Population Growth Will Continue:

Population growth drives demand. Its that simple. If supply doesn't match demand, prices must move up. After the borders reopened and migration levels again increased, Melbourne is expected to regain its position as one of Australia’s fastest-growing cities. Immigration, particularly from overseas, has historically driven demand for housing in Melbourne, and the city’s population is forecasted to increase significantly over the coming years. The return of international students and skilled migrants will add further pressure to the housing market, driving up both rental demand and property prices.

Melbourne’s population is forecast to rise by roughly 500,000 over the five years to 2026-27, after increasing by an astounding 1.7 million people (52%) so far this century.

That's the equivalent of two Hobarts’ worth of population growth in only five years. And yet look at Hobart's price above, Melbourne is just 16% more expensive currently.

In fact Melbourne’s population is expected to grow by one million people over the next ten years. Where will they all live?

Infrastructure Investment:

Melbourne continues to see large-scale infrastructure projects, such as new transport links, airport expansions, and urban renewal developments. These projects not only create jobs but also make the city more attractive to residents and businesses. Areas close to new infrastructure developments are expected to see higher demand for housing, leading to price increases.

PRO TIP: Buy a second-hand apartment, at a bargain price, with a current rent return of 6% rent return, near the new Anzac station before it opens shortly

Limited Supply:

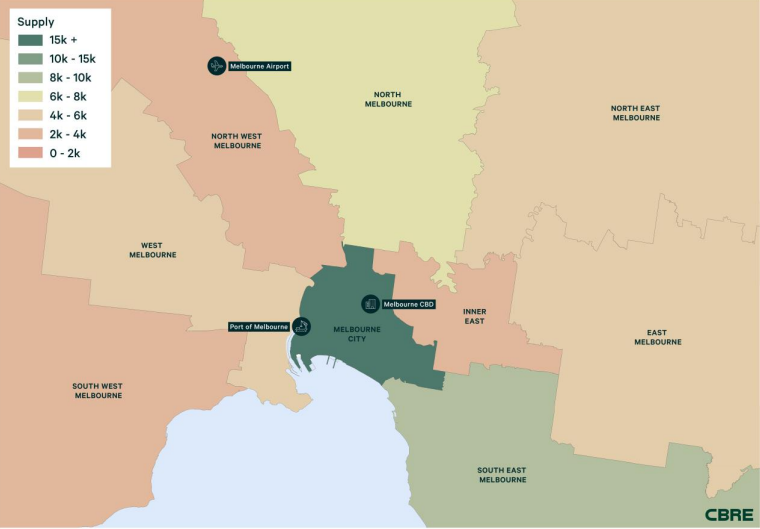

Melbourne’s property market is facing a tightening supply of new housing, particularly in high-demand areas. With construction costs rising and developers holding off on new projects due to economic uncertainty, the supply of new homes has slowed. And not just houses. New apartment supply is at a new low, and there is no recovery in sight. This imbalance between supply and demand is expected to drive up property prices as demand begins to recover.

Affordability Compared to Sydney:

While Sydney’s property market has always been more expensive, the gap between Sydney and Melbourne prices has widened greatly in recent years. Melbourne remains a more affordable alternative to Sydney for both investors and homebuyers. As affordability becomes a bigger issue for buyers, Melbourne’s relative value is likely to attract more interest, boosting demand.

Economic Resilience:

Melbourne’s economy is diverse, with strong sectors including education, health, finance, and technology. The city’s economic strength underpins its property market, providing resilience in the face of broader national and global economic challenges. As the economy continues to recover and expand, property demand is expected to follow.

This is creating a window of opportunity for home buyers and property investors with a long-term perspective.

And when interest rates start to reverse and buyers will come back into the market with a vengeance. The time to position yourself is before that happens.

If you are an investor looking for a bargain unit, with a high rent return, and prospects of strong growth over the next 3 to 5 years, this is good news. And represent a once in two decades situation.

There will be a clear flight to quality properties in Melbourne, with A-grade homes and "investment grade" units, townhouses and properties still in short supply for the prevailing demand. Currently B Grade properties are taking longer to sell and informed buyers are avoiding C Grade properties, such as new houses in the west, and many high rise apartments in the CBD and Southbank. APARTMENTS, either new in prime locations, with outstanding facilities and amenities to make them super attractive to future home occupiers not investors, OR second hand if you hold an Australian passport or citizenship, near transport links, shops and facilities, such as near the new Anzac station, will be excellent investments. Employ a buyers agent to do the running around and find you that elusive below value unit in the right building!

Early 2026 Will Be a Great Countercyclical Time to Invest

For investors willing to take a long-term view, the next 6-9 months could be an ideal time to invest in Melbourne property. While the market may be struggling in the short term, these down cycles are often the best times to enter the market and secure properties at more affordable prices.

Countercyclical investing can lead to significant gains when the market eventually rebounds. By purchasing when others are hesitant, investors can capitalise on lower prices and ride the wave of growth when conditions improve.

Melbourne’s property market is expected to follow this pattern, with the current downturn likely to be followed by a period of strong growth.

Moving forward strong immigration and a lack of supply of properties will help push Melbourne property prices up.

The market is not easily navigated. Feel free to schedule a no obligation call for 30 minutes where we can go through in detail the market.

I provide advisory services to buyers and sellers, and am always happy to discuss the market with anyone and while my service doesn't suit most people, I rely on referrals from people just like you who I have helped without any obligation or commitment.

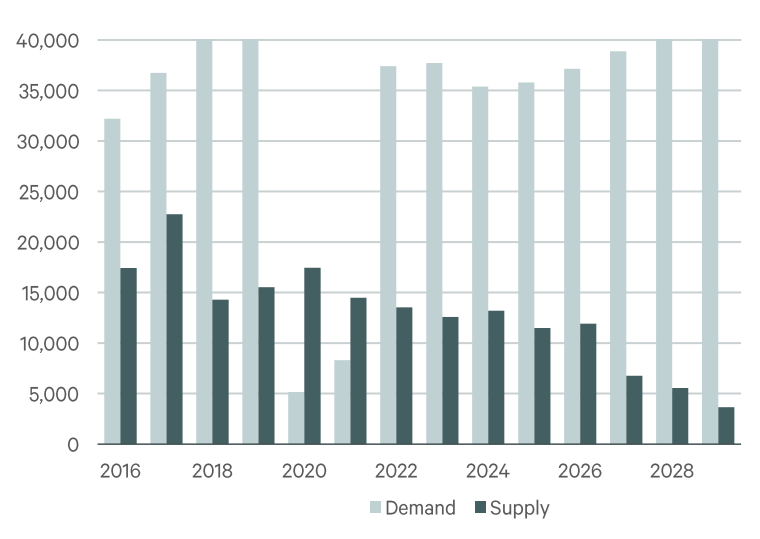

APARTMENT SUPPLY AND HEAT MAP 2016-2028:

CBRE estimates Melbourne's apartment delivery will average 10,000 pa over 2024-28, nearly 40% below Sydney.

-

Apart from Location – Location – Location - is there ANOTHER Golden Rule of Property Investing in Australia?

YES there is. It is the QUALITY of your property that is of major importance to it’s financial success going forward 2026 to 2028.

KEY POINTS

-

The quality of the property determines long-term investment returns.

-

Average-quality property yields average returns; above-average quality leads to above-average returns.

-

Combined with strategic locations near the water, city hubs, parks, shops, schools and supermarkets, helps ensure investment success. Wherever possible, focus in inner and middle ring properties ONLY.

-

Focused Investment Energy:

-

Direct energy towards asset quality working with your professional property buyers agent.

-

Outsource all other matters (tax, borrowing, property management, building inspections etc.) to advisors.

-

Attributes of Quality Property:

-

Sustained buyer demand exceeding supply.

-

Appreciating value/prices in the long run.

-

High-quality property is scarce.

-

Factors Impacting Supply and Demand:

-

In prime investment locations, supply is fixed or diminishing.

-

Supply includes land supply and dwelling type/style.

-

Land Supply Dynamics:

-

Well-established, blue-chip suburbs have fixed and finite land supply.

-

Outer suburbs may have abundant land supply due to releases within a 20km radius.

-

Property Type and Style Effect on Supply:

-

High-land-value locations see stable house supply; apartments can change more readily.

-

Example: Victorian style houses have finite supply, potentially diminishing.

-

Buyer Demand Exceeding Supply:

-

Buyer demand refers to potential buyers desiring property in a certain location.

-

Demand substantially exceeding supply leads to rising property prices.

-

Imbalance in Supply and Demand:

-

Invest where buyer demand substantially exceeds supply.

-

Notionally, 10 buyers for every seller ensures price stability despite changes in supply or demand.

-

Long-Term Price Support:

-

Despite changes, the number of buyers exceeds sellers, supporting prices.

-

Prices remain resilient even during supply increases or demand reductions.

-

Tip: Location Matters

Look for properties in inner and middle-ring suburbs. Avoid properties in the west, as they are unlikely to appreciate to the same level.

REMEMBER: MELBOURNE IS THE BEST "BUYER'S MARKET" RIGHT NOW IN AUSTRALIA, AND SHOULD CONTINUE TO BE SO - UNTIL INTEREST RATES DROP BY A FULL 1%, OR IF BRISBANE AND PERTH PRICES EACH RISE BY ANOTHER 5% TO 7% FROM CURRENT LEVELS - THEN DEMAND WILL OUTSTRIP SUPPLY AND IT COULD QUICKLY TURN INTO A "SELLERS MARKET".

To discuss the market, and see whether my Service For Buyers Can Help you, lets chat!

I have access to off market properties, pocket listings, as well as MOST properties currently listed on real estate.com.au and domain.com.au. I use a combination of exclusive date points, extensive research, data and contacts with agents to get access to many properties before they are publicly advertised.

Those properties that are already on the market now, I use all my knowledge, skills, experience, data and research as well as know-how to help you secure a great buy, working against the seller and their agent.

Call Mike Bentley