In a LinkedIn blog post in 2014, Richard Branson writes that the best lesson his father ever taught him was to protect the downside; that is, limit possible losses before moving forward with a new business venture.

Citylife International Realty has long advocated that its clients protect their downside first and foremost, and let the upside take care of itself when buying Australian investment property.

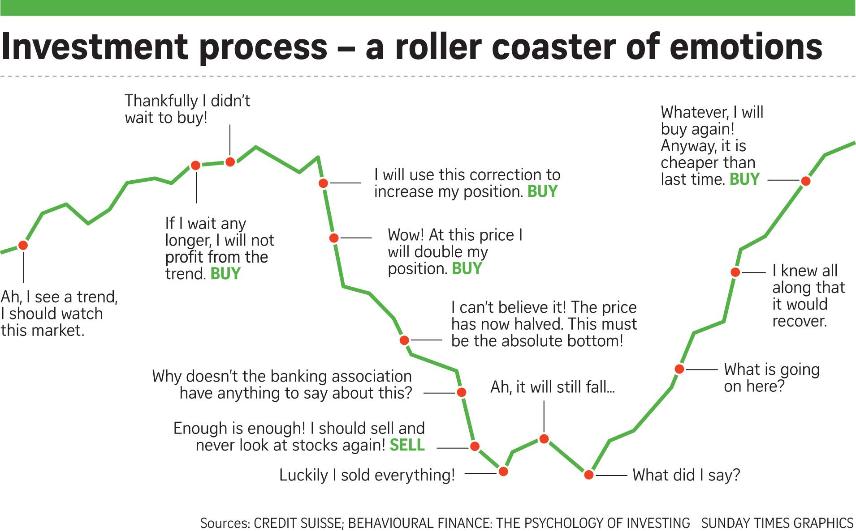

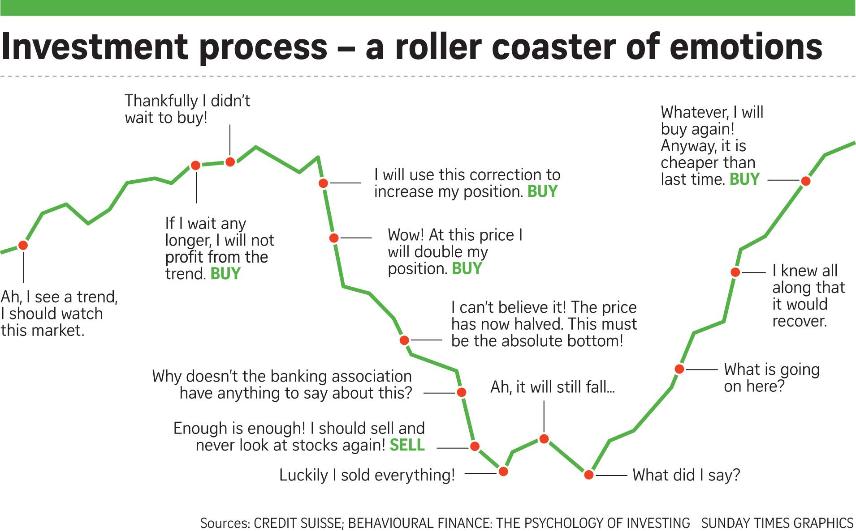

But property is not immune from market corrections. There are even some ARMAGEDDON predictions for the Australian housing market. A fall of 5% would not be totally unexpected at anytime over a 12 month period, but that would not be catastrophic. In fact, if that happened, one could realistically expect to recoup that "loss" quickly with a market rebound. BUT what happens if the prices fall 10%, or even more, especially due to Covid 19?

- How to select the right property

- how to rent the property out

- how to keep the property full

- how to manage repairs and maintenance

- how to minimise tax

- values falling after purchase

- oversupply

- no future resale

- no tenants

- tenants damaging the property

- a real estate collapse

- paying Body Corporate levies - property agent fees - tax on any rental income - council and body corporate rates - insurance - bank loan repayments - property taxes - land taxes...

- And so on!

Not understanding the details about rental real estate as an asset class and therefore being at risk in ways they can't even imagine, while others convince themselves that these headaches and costs make property not a worthwhile investment.

They feel vindicated that their inability to take action is the correct decision.

(Terms and Conditions Apply, and Citylife Approved projects only)

(c) Copyright Citylife International Realty. Privacy Policy and Terms of Use