AUSTRALIA'S FIRST HOME* OWNERS GRANTS

*("Home " means property: house, townhouse, apartment, unit etc)

Grants and concessions available for each state

Below you’ll find the grants and stamp duty concessions available in each state. Remember there are a host of eligibility requirements for the grant and duty concessions which can vary from state to state.

NSW

Is there a first home buyers grant?

Yes, the First Home Owner Grant (New Homes) scheme offers a $10,000 grant for the purchase or construction of new homes. The value of the property of a newly constructed property must be under $600,000. If buying land to build a property the combined land and dwelling valued must be less than $750,000.

Are stamp duty concessions available?

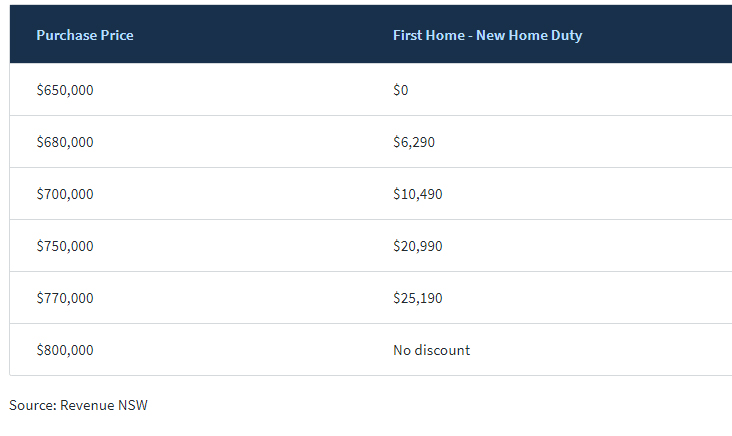

Yes, the First Home Buyers Assistance scheme provides first home buyers with exemptions from transfer duty on new homes valued at less than $650,000 and concessions for new homes valued between $650,000 and $800,000. No duty is payable by eligible purchasers buying a vacant block of residential land valued at up to $350,000, while concessions are available for vacant land purchased for between $350,000 and $450,000.

Transfer duty breakdown (for first home purchases)

VICTORIA

Is there a first home buyers grant?

Yes, the $10,000 First Home Owner Grant is available to eligible applicants buying or building a new home valued at up to $750,000 in metropolitan Melbourne. A $20,000 First Home Owner Grant is available to applicants buying or building a new home in regional Victoria valued up to $750,000.

Are duty concessions available?

First home buyers purchasing a new or established home valued below $600,000 will be exempt from stamp duty, while buyers purchasing a new or established home valued between $601,000 and $750,000 will be eligible for a stamp duty concession, applied on a sliding scale.

QUEENSLAND

Is there a first home buyers grant?

Yes, the Queensland First Home Owners' Grant offers $15,000 to first-time owners buying or building a new home. The grant is available for properties valued at less than $750,000.

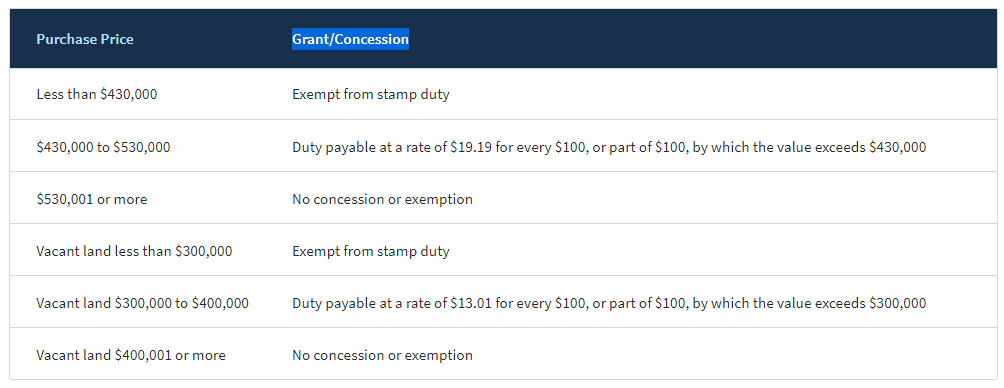

Are transfer duty (stamp duty) concessions available?

Yes, stamp duty concessions are available if you buy a home valued less than $550,000 or vacant land less than $400,000. The more you pay for your home or land within these limits, the smaller the concession available.

WEST AUSTRALIA

Is there a first home buyers grant?

Yes, the FHOG of $10,000 is available if you are buying or building a new home. Eligible properties located south of the 26th parallel of south latitude are limited to $750,000, while properties north of the 26th parallel of south latitude are limited to $1 million.

Are stamp duty concessions available?

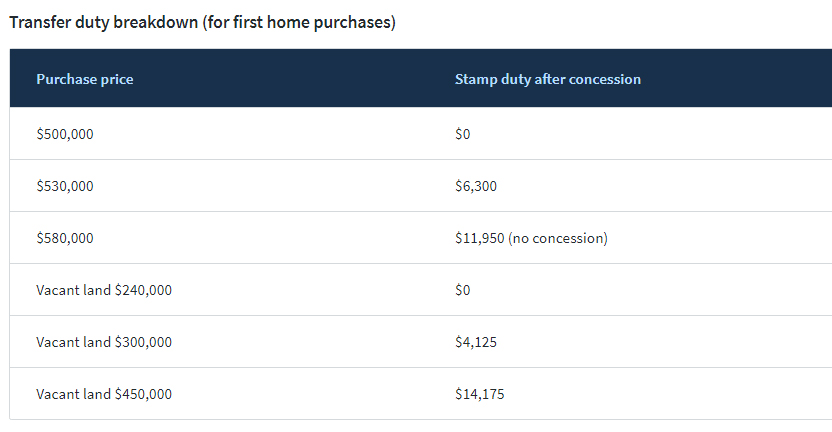

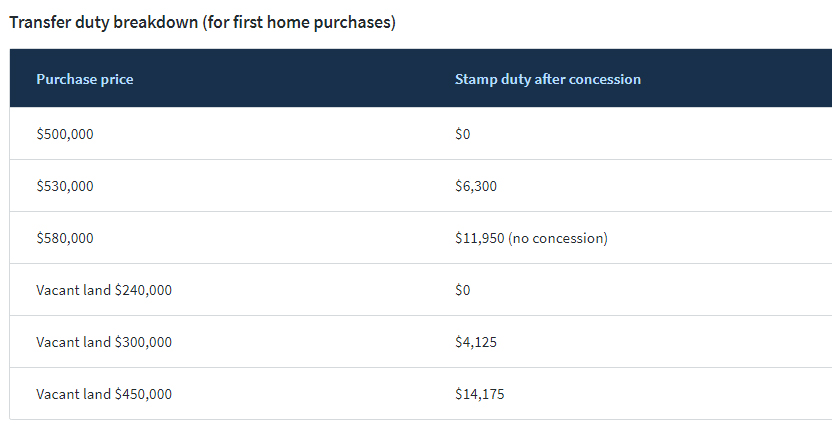

Yes, the First Home Owner Rate of Duty provides exemptions and concessions when purchasing homes valued at less than $530,000 and vacant land less than $400,000.

Transfer duty breakdown (for first home purchases)

NEW: Off the plan Duty and Foreign Buyer exemptions:HUGE new exemption in Perth...READ MORE HERE

SOUTH AUSTRALIA

Is there a first home buyers grant?

Yes, the FHOG of up to $15,000 is available for the purchase and construction of new homes valued up to $575,000.

Are stamp duty concessions available?

There are no exemptions specific to First Home Buyers but you may be eligible for the off-the-plan stamp duty concession if you purchase a new or substantially refurbished apartment, capped at the stamp duty payable on a $500,000 valued apartment.

Am I (or my children) eligible for the First Home Owners Grant?

The eligibility criteria for first home buyers differs slightly between the states and territories but generally, eligibility criteria includes:

- You must be a first home buyer as a person, not as a company or trust.

- At least one applicant must be a permanent resident or Australian citizen.

- Each applicant must be at least 18 years old.

- You or your spouse, partner or co-purchaser must not have previously owned an interest in land in Australia which had a residence on it, before 1 July 2000.

- You or your spouse or partner cannot have lived in a residential property which you owned from 1 July 2000.

- You or your spouse, partner or co-purchaser may not have claimed the grant previously.

- You must occupy your first home as your principal place of residence within 12 months of the construction or purchase of your home and the minimum period of occupancy is 12 continuous months.

There are other state-specific conditions as well, which will depend on the state you’re buying in.

Some of your questions about the first home owners grant answered

To help you to understand the First Home Owners Grant we have compiled a list of answers to some of the most frequently asked questions by overseas buyers:

- What happens if I move out of, or rent out, my home in the first 12 months? If you have lived in your home for a continuous period of six months, you may keep the grant, but if you move out, or rent it out, before this time, you need to repay the grant.

- Can I apply for the first home owner grant if I'm a temporary resident? Unfortunately first home owner benefits aren't available for temporary residents. They also can't be retroactively applied for once permanent residency is obtained.

- My partner and I are buying the property jointly and neither of us has owned a property before. Do we each get a grant? No. A single grant is payable per property transaction not per person.

- Does my income affect the grant and is the grant taxed? No, the grant is not means tested and you do not have to pay tax on it.

- What sort of home qualifies me for the grant? Depending on the state or territory an eligible home may be a new or established Australian house, home unit, flat or other type of self contained fixed dwelling that meets local planning standards. The specific rules vary by state.

- I am buying an older existing home, NOT brand new. Does that qualify me for the grant or does it have to be a new home? This depends on the state, with many now limiting the grant to purchasers of new property only.

- I'm buying a home in Australia but I already own property outside Australia, does that mean I don't qualify for the grant? You can be eligible for the grant provided you have not owned property in Australia before. Your overseas property makes no difference.

Where to from here?

Yes, buying your first home, or helping your children get into the market, is complicated, and yes, for young people trying to save for their first home deposit is a monumental task. But while it can be a hard and expensive journey, you can make it easier and more affordable if you hold all the information and get expert help.

If you need a professional working with you all the way, you can use Mike Bentley's services.

Read more here.

.jpg?timestamp=1572489748098)