The 88 Billion Build to Rent Property Bonanza Coming To Australia...

(continued)

Will there be an oversupply of rental property?

My analysis says: No.

Not in the foreseeable future!

In 2020, of the 14, 547 BTR units in total, only about 2,300 were under construction.

Even if all 14,547 were to be built, that would still only mean institutions would own 0.4% of all rental stock.

And national vacancy rates were at a decade low nationally in October 2021, at 1.6% (SQM Research) signifying a low level of rental property available across the country.

Of course, some areas remained in oversupply, however, many locations around Australia were severely undersupplied with rental accommodation, and had virtually zero vacancies.

And that’s with the international borders closed, and a decrease in net overseas migration by 334,600 people in the year ending 31 March 2021, and students locked out.

According to the Australian Department of Education, Skills and Employment (DESE) as of 28 June 2021 just under 160,000 students were locked out.

With the vast majority of students destined for Sydney and Melbourne, SQM Research reported in August 2021 that a total of 42,142 private rental properties were vacant in those two cities (which does not include specific student housing or on-campus accommodation).

Many developers report “no shortage of tenants” with many suburbs showing less than 1% vacancy in mid-2021.

A recent survey from Apartment List in the US found that 18% of millennials expect to rent forever, up from 11-12% in the prior two years.

The number one reason for this is that they don’t have the money to buy, but the number two and number three reasons are that they like the flexibility of renting, and that they don’t want the cost and hassle of home maintenance.

While I haven’t seen a similar survey done for Australia yet, I guess it would be similar.

That speaks to the fastest-growing segment of demand: renters by choice.

They could buy, but they choose to rent for the sake of convenience and flexibility. And it is these people that will be attracted to, and developers are looking to attract to, Build to Rent.

Built-to-Rent appeals to singles, families with young children, single parents and divorced people.

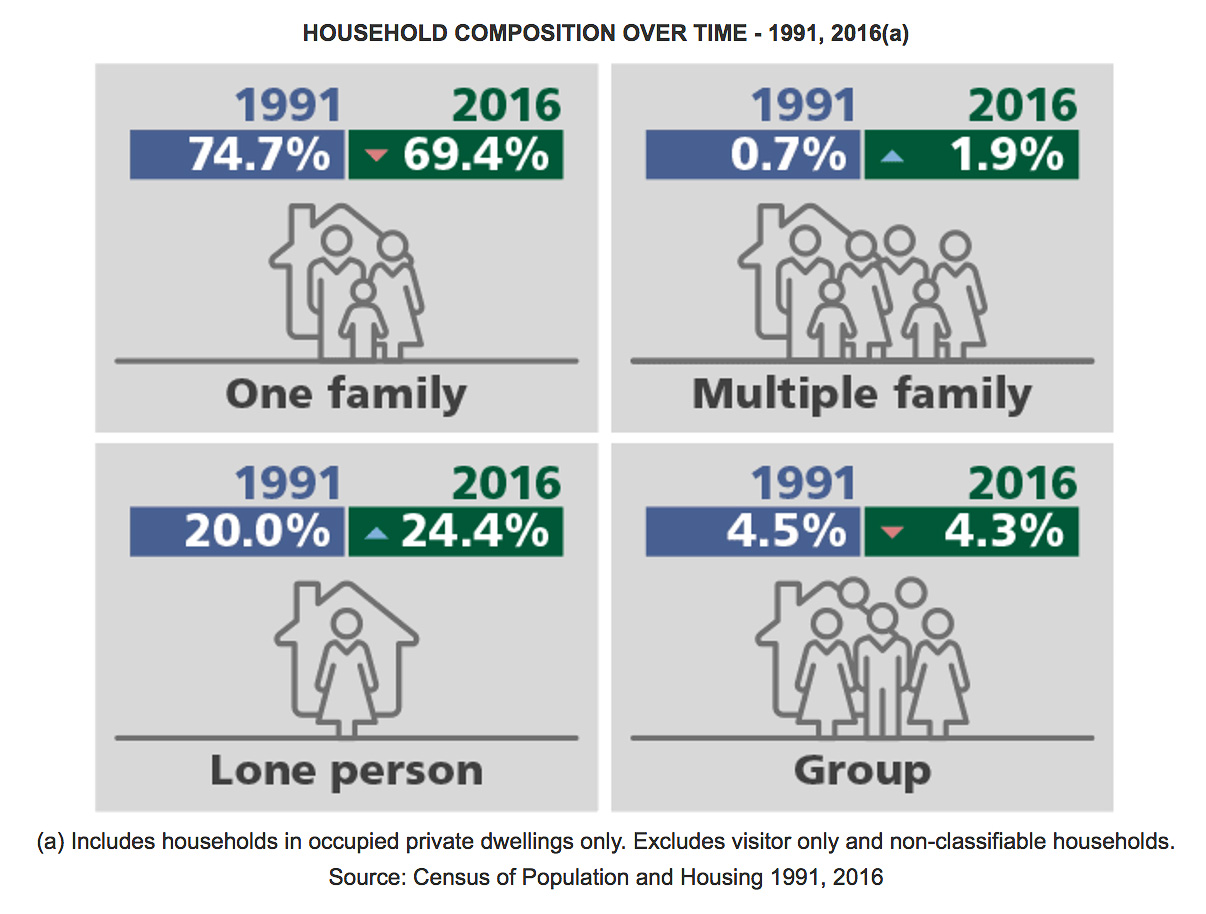

Above all, singles are a growing segment of the population, representing around 24% of all households in Australia (2016 Census) and increasing.

In the US single-person households account for a massive 49% share in apartments.

(National Multi-Family Housing Council).

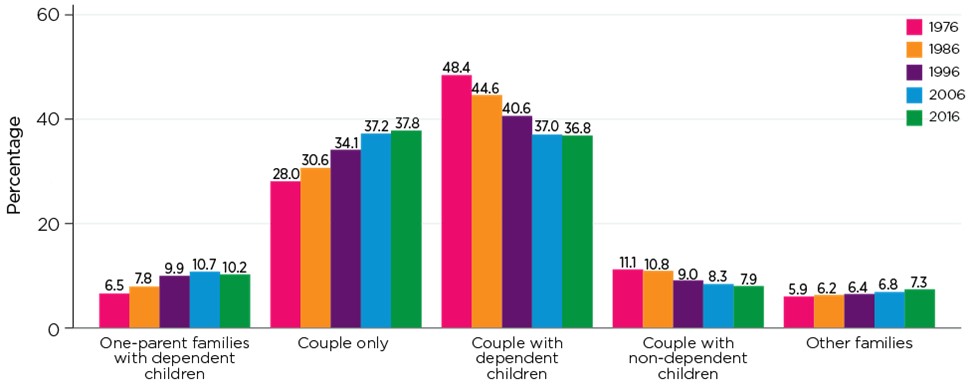

And couples WITHOUT children are now the most prevalent group in Australia, overtaking couples WITH children for the first time.

According to the 2016 Census, there were 6,070,000 families in Australia.

Most of these families represented couples without children (37.8%) and couples with dependent children (36.8%).

From 1976 to 2016 :

- The proportion of couple families without children increased.

- The proportion of couple families with children decreased - a trend that applied to both those with dependent children and those with non-dependent children only.

Note: Other families include one-parent families with non-dependent children.

Sources: ABS 1976-2016 Censuses

Credit: Australian Institute of Family Studies 2020

Across all groups and segments of the population, the pace of household formations (the primary driver of housing demand) will continue to increase.

- The Australian Bureau of Statistics has projected that the number of households will increase from 9.2 million in 2016 to between 12.6 and 13.2 million in 2041.

Demographic trends, including strong migration post Covid, will converge to drive demand for rental property ever higher, but construction of new apartments is not keeping up.

High rise particularly has plummeted since the approvals peak 2015-2016.

That’s why vacancy rates started falling in early 2021 to near record lows in many areas even with no migration or student arrivals.

But it’s not as easy as just deciding to provide Build for Rent properties to help supply.

The number-one constraint is suitable sites.

The location has to be correct, and the best locations are scarce and expensive.

And the for-sale market in Australia is booming on the back of record-low interest rates, pent-up demand, and scarcity of new supply of apartments.

How Big Will The BTR Market Become In Australia?

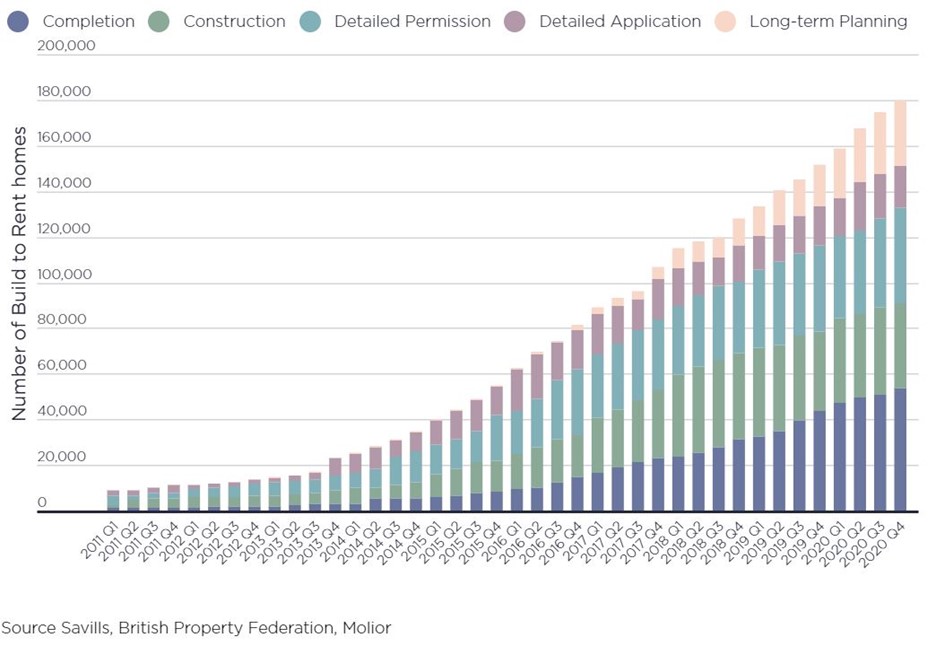

When we examine what is happening in Australia, following the explosion in the UK Build to Rent market, the growth potential inherent in the BTR market in Australia is huge.

After a sluggish start, the UK Build to Rent market exploded. In 2020, Knight Frank estimated that 41 billion pounds (AU$76 billion) were committed, with another 19 billion pounds (AU$35 billion) ready to be deployed.

According to Savills, (UK Build to Rent Market Update – Q1 2021) the UK’s BTR stock now includes 57,700 completed homes with a further 36,000 homes under construction.

The future pipeline currently stands at 94,700 homes, including those in the pre-application stage. Once these are all completed, the total size of the sector will be 188,500 homes.

This chart shows the potential of BTR in Australia to 2028 if it follows the UK trends.

Build to Rent in Australia represents a significant opportunity for institutional investors and wholesale and sophisticated investors in private equity deals, which are very common in the US.

BTR developments are attractive to large investors and developers as they can provide a relatively safe and steady cash flow through rental income when done well.

Built with the resident in mind, tenants benefit from flexible tenancies that often include utility bills, no lettings fees, modern features and added amenities such as a gym and residents lounge to promote a community feel.

As they’re managed by a professional company and come with added extras, there is a 10-20% rental premium on the units making them more expensive than renting via a traditional landlord in terms of pure rental.

However, BTR projects include many costs tenants often have to pay separately, such as internet, cleaning, gas, electricity, water, and have more flexibility on leases and all appliances and fittings and furniture are included in the rental as well as often offer a lower deposit bond -

In all, making the overall costs to tenants cheaper than a standard rental.

All up, it seems to be win-win for tenants and operators.

This growing asset class represents somewhere around 11% of all housing in the US and will be just under 1% in the UK.

The value of the Australian residential market as reported by CoreLogic in August 2021 was AU$8.8 Trillion.

In the US, there are around 43M rented properties, with institutional ownership accounting for 15M, or 35%.

The growing UK market will mean around 4% of all rented properties will be BTR after all currently in planning are completed.

If 1% of Australia’s current housing stock transitioned to BTR, it would represent an AU$88 billion prime property investment opportunity.

Another way to see the potential is that there are around 3.36 million investment properties in Australia.

The average investment property value is currently about 60% of the median house price.

With capital cities median house prices in mid-2021 sitting at just over AU$1M, that makes the average investment property value at AU$613K, meaning the total value of all investment (rented out) properties in Australia can be estimated at over AU$2 trillion.

If the BTR market takes over just 4% of Australia’s rental market over time, we see an AU$80 billion plus market potential again.

My take is that even if all the planned units in Australia get off the ground and are completed, they still won’t be anywhere near enough to meet all of the demand for this product.

(Note: some submarkets in the Build to Rent space -significantly the more expensive, larger “family” style apartments - are likely to start to feel crowded with supply in three or four years, but there still won’t be an Australia wide glut).

Build to Rent is a hot topic in Australia right now.

The demand is there, and the increase in supply lags the total aggregate demand for some time.

Hold on to your hats.

The BTR boom is just beginning!

Once these are a;;

I am the Managing Director of the award-winning realtor, Citylife International Realty in Central, Hong Kong and am a property consultant, advisor and researcher, who provides property consultancy services and Australian Build to Rent market advisory and research for developers, BTR investors, and rental operators.

My other company is my personal investment company, Aurient Limited. I have conducted numerous seminars and webinars on the Australian real estate market, and have contributed many hundreds of articles and analyses on housing trends and demand at the local market level as well as Australia specifically for Asian investors. I have also published three books on Australian property investing for Asian-based clients.

DISCLAIMER:

All information contained in this article is obtained and / or compiled from sources believed to be accurate, reliable and current at the time of release However, Michael Bentley, Citylife International Realty and Aurient Limited cannot and does not warrant, guarantee or represent, either expressly or implicitly, the accuracy, validity or completeness of such information. Michael Bentley, Citylife and Aurient and its affiliates or any directors or employees of Citylife and or Aurient or its affiliates shall not be liable for (whether in tort or contract or otherwise) any damages arising from any person's reliance on this information and shall not be liable for any errors or omissions (including but not limited to errors or omissions made by third party sources) in this information. The information provided herein is subject to change without further notice. This article provides general information on Build to Rent around the world and in Australia, but such information should not be regarded as an offer or a solicitation of any offer to buy, sell or invest in any securities, syndications, investments or real estate.