How Does Raising Interest Rates Bring Down Inflation?

Inflation is high, interest are going up, and bond and stock prices have dropped. Property has boomed during Covid, but is slowing now in some places.

This is a challenging period for anyone who has savings and investments or is thinking about making some investments.

“Wait and watch” seems to be the underlying trend; unfortunately, inflation will eat away what cash savings you have. As Warren Buffet recently said, “inflation is swindling investors and cash hoarders alike.”

Michael Bentley, July 2022

While I’ve been analysing and writing about Australian property for more than 35 years, I am not an economist. But I did experience the high inflation in Australia last time around and saw first-hand what happens to property prices when inflation and interest rates are high.

But first, let’s find out WHY the Australian government is raising interest rates to try to lower inflation?

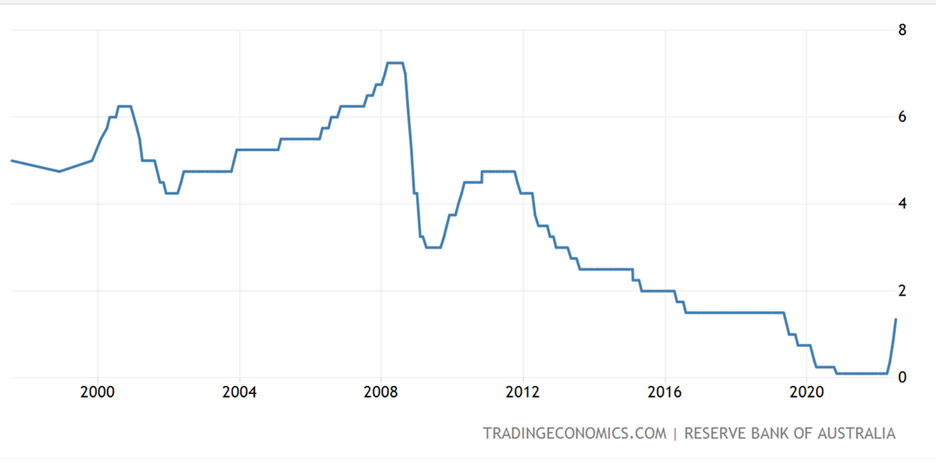

Australia’s central bank, the Reserve Bank of Australia (RBA), raised interest rates by the most since February 2000 as it adopts a more aggressive approach to curbing rampant inflation. The Reserve Bank of Australia’s decision to increase rates by 0.5% on the 7 June marked the first time the bank introduced back-to-back rate rises since 2010.

Then on 5 July the Reserve Bank raised rates another 0.5%

The RBA said:

“Global inflation is high. It is being boosted by COVID-related disruptions to supply chains, the war in Ukraine and strong demand which is putting pressure on productive capacity. Monetary policy globally is responding to this higher inflation, although it will be some time yet before inflation returns to target in most countries,"

RBA Governor Philip Lowe said that the RBA board would "paying close attention" to household spending in the coming weeks and months before deciding on future rate increases.

"One source of ongoing uncertainty about the economic outlook is the behaviour of household spending. The recent spending data have been positive, although household budgets are under pressure from higher prices and higher interest rates. Housing prices have also declined in some markets over recent months after the large increases of recent years," he said.

Inflation is expected to increase further but then decline towards the 2-3 per cent range next year. Higher prices for electricity and gas and recent increases in petrol prices mean that, in the near term, inflation is likely to be higher than was expected a month ago.”

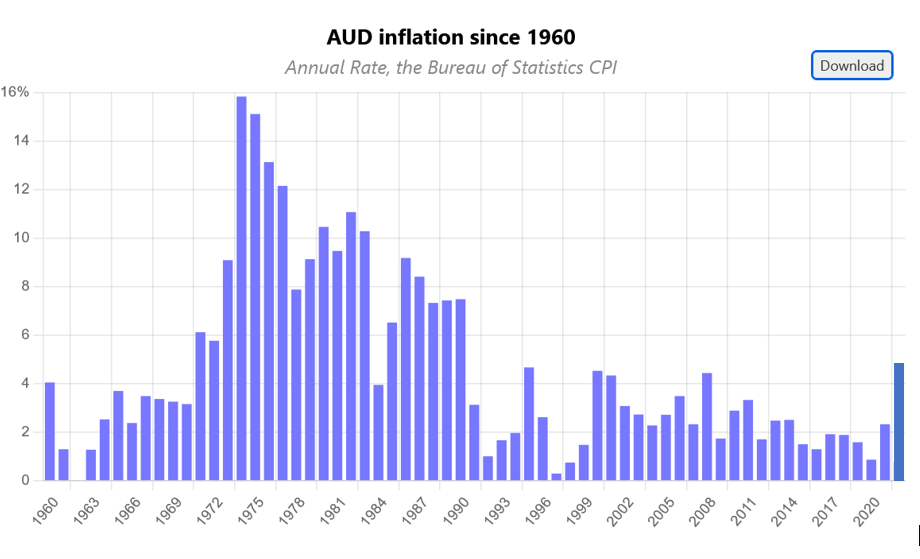

Inflation reached 5.1% in Australia in the first quarter of the year, the highest since 2003, but the RBA expects it to stabilise back to 3% by next year.

Resilience

The RBA praised the resilience and flexibility of the Australian economy, with a 0.8% growth rate in the first quarter of the year, while expecting a 3.3% growth rate overall in 2022.

The Labour Sector

The RBA also noted the strength of the labour sector, with unemployment falling to 3.9%, the lowest in 50 years.

Wages are also rising considerably as companies compete for the tight labour market.

Rate Expectations

Under all these conditions, the RBA said it’s unnecessary to continue offering extraordinary support for the economy, thus the move to hike rates by 0.5% on the 7 June.

Aussie Dollar

Aussie continues to strengthen against the USD, with analysts expecting it to hit 0.8 by year’s end if the RBA keeps up the rate hikes.

What About Supply and Demand?

How does raising interest rates help? The RBA is making it more expensive to borrow money by raising interest rates, of course.

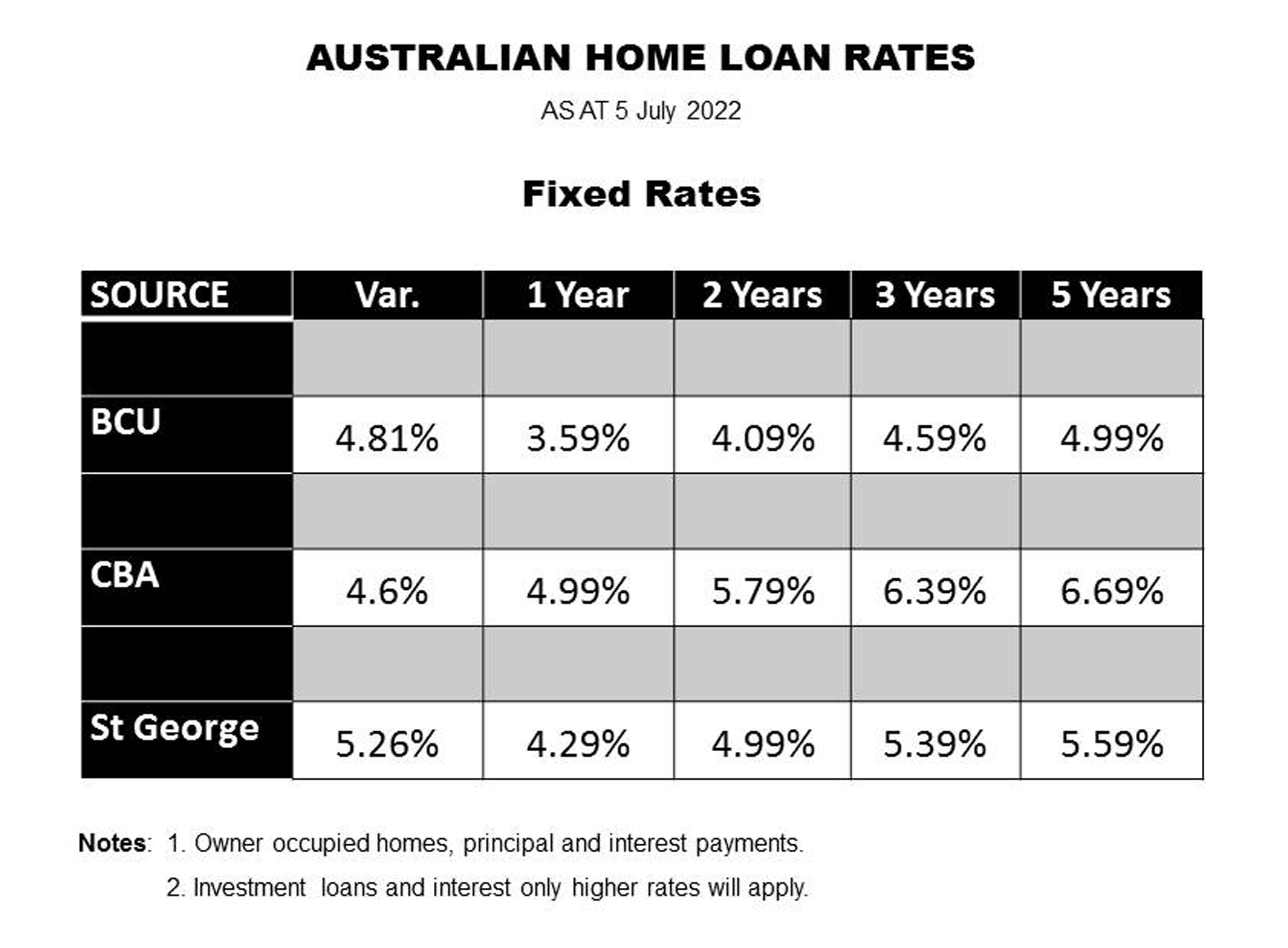

Mortgage rates rising, making it more costly to buy property.

This will not lower home prices immediately. The supply of new property is short, the cost of materials is rising, labour is in short supply, population growth through migration is high, and demand for homes and real estate is so strong, mainly because of the pandemic.

The RBA can’t do much about those things.

By raising rates, the RBA is hoping to slow down spending. When the cost of money goes up for loans and mortgages, fewer people borrow.

The higher cost of money reduces purchasing and borrowing power. And the theory is that then brings down inflation, as there is less demand.

Professor Edmund S. Phelps, a Columbia University Nobel prize-winning economist who won the award for his ground-breaking work on the connection between inflation, wages and unemployment, said this (his comments relate to the US, but the same principles apply to Australia):

“You can look at our situation as aggregate demand exceeding supply, and that’s causing prices to rise. If interest rates go high enough for long enough, economic growth will slow and some people will lose their jobs. When the unemployment rate turns out, after careful analysis, to be very low, and when inflation is high, then we do want to put a lid on it and the Fed does need to raise rates. But that will have consequences.”

An economic slowdown associated with a decline in the inflation rate could deteriorate into a recession, but the RBA clearly wants to avoid that.

The RBA’s pronouncements about where it expects interest rates and inflation to go are called “forward guidance.”

Financial markets are reacting not just to what the RBA does but also to what it says it will do.

But what is interesting, for some banks the 1 year fixed rate is BELOW the current variable, and even the long term fixed rates are NOT significantly higher than today's varaible rate, indicating that what Macquarie Bank recently said

"Rates are going up, then coming straight back down"

may be right.

Interest Rates and Shares: Not a Simple relationship

One may assume rising rates will cause the share market to fall. People have less money to spend or invest, so there is less demand for goods, services, and stocks.

But historically, it hasn’t been as simple as that, according to Oliver.

“There is an ambiguous relationship between rising interest rates and the Australian share market,” he said on the AMP blog.

“While higher rates place pressure on share market valuations by making shares appear less attractive, early in the economic recovery cycle this impact is offset by still improving earnings growth.”

Undoubtedly, share prices have fallen on some occasions when rates have increased. But other times, the All Ordinaries has done the opposite.

“For example, between 2003 and 2007, shares went up as interest rates rose, with shares only succumbing in 2008 after multiple rate hikes over several years and with the GFC.”

Infaltion, interest rates and Aussie Property

While there is not a 100% accurate crystal ball, it can be helpful to look back at the only other time in memory when Australia had high inflation to help understand what might happen going forward to 2024.

Download the “Australian Inflation and Property“ report here.