THE FULL STORY BEHIND THE "TERRIBLE INVESTMENT" THAT BOB MADE

This is the true story of “Bob.” An older Australian living in Hong Kong.

This is a rather long story, but I think it is actually an incredible story, if you are a serious BUYER, or OWN any Australian property, it is well worth following, as there are lessons here for everyone.

I met Bob when he arrived in Hong Kong more than 25 years ago, and he made two property purchases based on my recommendations:

One in Sydney, in Crows Nest, a terrific lower north shore suburb. He purchased a 2-bedroom, 2-bathroom spacious (90 sq. m) apartment off -the- plan with a car park.

He also put a 10% deposit on an off- plan apartment in Brisbane.

To hedge his bets.

The Brisbane one completed in 2004 and he took possession for AU$303,000.

The Sydney one completed a year later, and as you would expect was quite a bit more expensive. More on Sydney in another post.

The Sydney story is even more tragic for Bob than the BRISBANE ONE.

The Brisbane apartment was also a great size (90 sq. m) 2-bedroom, two bathroom with one car park in Spring Hill, an inner Brisbane suburb.

He secured a 90% mortgage on interest only, meaning he only had to outlay his initial 10% $30,300 (plus legal costs and stamp duty).

The apartment has been rented and seldom been empty since Bob took possession.

Many times over those years, and I mean MANY times, has he has asked me whether he should sell this apartment as it is “terrible investment” and he would have been better off leaving his cash in the bank where he could “have got a far better return” without any hassles.

On several occasions over the years I have shown him on the back of an envelope how the property calculations worked, but like many people he just didn't get it.

He was hoping to make windfall gains on the capital growth - if not overnight - at least in a couple of years.

And when this didn't happen, he thought he should sell.

So after only 2 years of holding the Sydney one he HAD sold it, as it “wasn’t moving” and he "couldn’t afford to hold it any longer."

And a NUMBER OF YEARS later he wanted to unload his Brisbane one too as he said that with all the expenses he was “bleeding money every month” as the rent did not “even get close” to covering the mortgage, the Body Corporate Fees ("they are cheating") and all the expenses.

Without even looking at the figures, I knew that after so many years of ownership, and even though he had borrowed 90% of the price, that this is impossible.

Bobs Brisbane unit

So I sat down and got all the calculations from him, the rent receipts, the bank statements, all the invoices and expenses and loan documents, and what I discovered was SHOCKING.

THE REALITY...

There are a few ways to look at real estate investments.

I addressed initially his immediate concern - the CASH FLOW.

After going through his statements for the previous 12 months, I put together an Excel spreadsheet for him.

Not only had he NEVER done this, BUT he barely could find his expenses or loan documents, he didn’t know what interest rate he was paying or how much his Body Corporate expenses were.

(If you are a detailed person, you may find this unbelievable, but I can say from my 35 years in the business, there are MANY investors just like this)

All he “knew” was the Body Corporate was “overcharging” and maybe even “cheating”, the bank repayments were "way too high", and all the repairs and upkeep on the apartment was “killing him.”

As you can see from the spreadsheet I prepared below, the repairs and upkeep that was “killing him” was $65 a week for the previous 12 months. Not too bad for a 17-year-old apartment.

The body corporate fees were standard charges for a building of the size he owned.

And all the other costs were normal.

The flat was generating $500 per week in rental income - even in the middle of Covid 19. And it had hardly been empty, ever.

He was also getting an extra $20 a week for his car park, as the tenants didn’t own a car so he could rent that separately .

Here is the EXACT spreadsheet I gave him:

So the apartment investment that was “killing him financially” ACTUALLY was cash flow positive to the tune of A$184 per month!

So it was hardly “bleeding him dry.” And while it was not earth shattering, there WAS something not quite right right.

In fact, I have seen many property owners over the years feel the same. They hate paying the bills, the Rates, the Body Corporate fees (who doesn't?). And they don't even know if the property is paying its way or not.

Now it gets even more incredible. I was shocked to see there were TWO mortgages on the property.

The first one was $272,700 which represented the original 90% loan he took out when he purchased. Fine and as expected.

Obviously, he had never made ANY capital repayments in that time as he had kept it on Interest only, whereby he was only required to pay the interest. Which was also fine.

BUT he seemed to have ANOTHER mortgage on the property, ALSO interest only at same interest rate, for $79,808.

When I asked him about that he said “Oh, THAT - yes, when the value of the flat went up, I was able to refinance and get another $80K out against the new value!”

II asked what he did with that $80K, as this is the exact strategy many people use to buy another property. He said he had used it for “other investments”.

(More about that shortly)

So, if he hadn’t re-mortgaged, the real return on the flat would be CASH FLOW POSITIVE to the tune of $416 per month.

RETURN ON INVESTMENT (ROI)

The other thing I analysed for him was the ROI.

He paid $303K, and as of November 2020 when I originally wrote this article, at the end of Covid 19, the valuation of the property was approximately $435,000.

(UPDATE AS AT EARLY 2025 IT WAS WORTH

Obviously, it had come down during Covid as he did say a couple of years ago it had reached over $470K

His comments were “I’ve barely made $100K in 17 years, it’s a hopeless investment, I honestly wished I had left the money in the bank.”

Remember, he had paid $303,000, and it was now worth around $435,000. So he was right, it wasn't the highest performing property of all time.

But let's also dig a little deeper. Accepting the fact it hasn’t been a particularly strong capital gains performer, he also hasn’t LOST his capital. The $80K he pulled from the flat I subsequently found he had invested in coal shares and in a plot of land in Thailand, both of which were disastrous.

The whole $80K was lost.

But he is still having to repay it from the rent on the flat.

(He is currently pursuing legal action on the shares, and given up on the land)

So let’s see his REAL RETURN.

Now, I showed him this several times over the years, and he STILL doesn’t get it. He just says “It's only gone up $100K... it’s hopeless”

So here are the actual calculations: (simplified)

Price $303,000

Deposit he paid $ 30,300

Loan 90% $ 272,700

ROI

Assume value is $435,000 (According to bank valuation)

Payback loan ($272,700)

Cash back $162,300

Invested $30,300 received back $162,300* means ROI is equal to 435% return over 17 years from when he took possession.

For a “terrible investment” not too bad!

BUT DO READ ON AS IT GETS WORSE!

Especially when we compare to his shares and land in Thailand, where his capital has been decimated.

And we know that the freehold apartment in Brisbane has not only maintained its value and his capital is safe and secure, but it also has in fact increased - albeit not as strongly as some other property investments, and certainly if he had held his Sydney apartment he would be sitting on a small fortune now.

PLEASE SEE BELOW FOR THE 2025 UPDATE!

If you have followed Bob's story so far, you are going to want to see the 2025 update below!

BUT IN THE MEANTIME, WHAT ABOUT "CASH IN THE BANK" AS AN ALTERNATIVE?

Let's go back to Bob's comment that he would "have been much better leaving off the money in the bank.”

The Australian bank savings rates back in 2002-2004 were around 5% and THEN DROPPED to virtually 0% before coming up again in recent years. So let's give him the benefit of the doubt- and say that he achieved an average of 3% per annum every year with his $30,300 in the bank.

And I have taken it for the full 19 years since he first placed his 10% deposit to make an accurate comparison.

Below is the chart.

I've also allowed for an extra 2% increase as a comparison value to account for the recent increases to see if he had been able to get 5% average per year what the result would have been.

So if he HAD left it in the bank, he would now have $53,540, compared his property equity of $162,300.

Even if he HAD managed to get a fixed 5% return for the whole period, he would still only have $78,192, less than HALF what his “terrible investment “ had made.

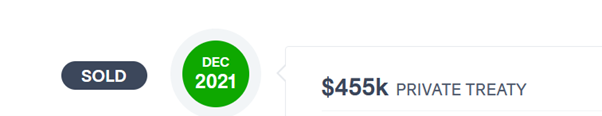

He did in fact sell the property for $455,000 at the end of 2021.

So, the final calculations - without boring you- going through everything again is:

On his actual selling price: 502%. Pretty good!

But here is the kicker - THE 2025 UPDATE!

THE 2025 PROPERTY VALUE AND RENTAL VALUE ACCORDING TO A LOCAL AGENT IS:

"The estimated property value of XX XXX Street, Spring Hill,is $650,000 with a potential rental income of $725 per week"

On the 2025 value: 1,145% Return on his cash outlay.

Yes, over 1,000 per cent return.

And THAT my friends, is WHY the use of OPM (Other People’s Money), leverage and compounding makes even an average - or to use his words a “terrible” - real estate investment one of the best things you can do with your money, especially compared to leaving cash in the bank, to be decimated by inflation too.

(PS He then complained about having to pay Profits Tax on his gains, as he still believed he had not made any money)

*For illustration purposes and simplicity the calculation excludes purchase and selling costs and tax.

I have many similar stories especially around selling too soon. If you would like to chat about selling YOUR property, or if you would like to discuss buying strategies, lets chat. Remember, I don't sell properties, but can advise you on the best way to SELL, or BUY.