Is 2025-2026 the Year of the Apartment?

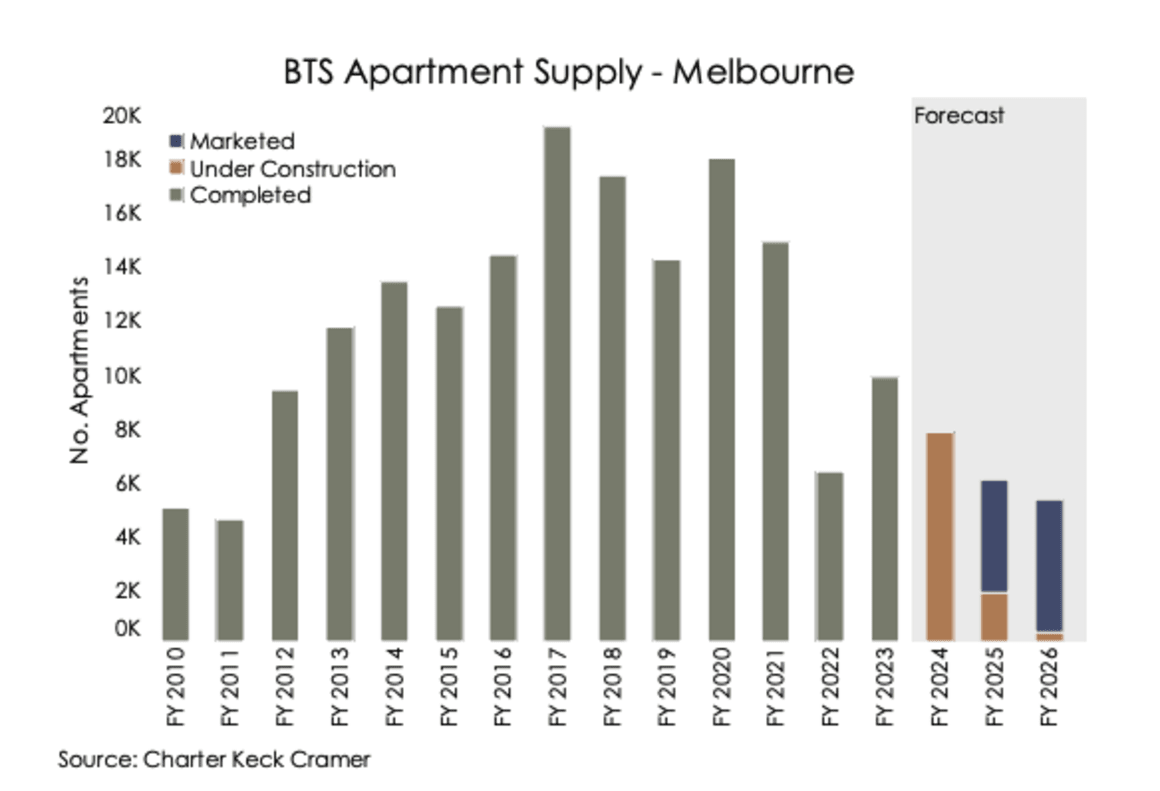

There are many reasons that 2025-2026 could see a resurgence in prices in second hand apartments, especially in Melbourne, which include the differential between what a house costs and what an apartment costs, the rising population, dropping interest rates, and the fact that Australia’s capital cities are facing a huge shortage of new apartments.

"In Melbourne in 2019 a new 60-square-metre apartment used to sell for $600,000 and now needs to sell for around $780,000,” said Richard Temlett, the national executive director of consultancy Charter Keck Cramer. Developers just won’t develop if it means they won’t make money.

And this is reflected in the supply graphs shown below. While Melbourne is the market hardest hit for supply, it’s also a problem in Sydney and Brisbane.“The difference between new and established units is too wide for buyers to be enticed to purchase new dwellings,” Mr Temlett said. “The prices of established units need to recalibrate upwards by around 15 per cent for new stock to be accepted by the market at current economic price points (around $13,500/sq m).”

That is going to worsen Australia’s chronic housing shortage. Costs won’t fall – although the rate of gain is likely to slow – and developers will hold off new apartment projects until established apartment prices rise enough to make new off-the-plan homes competitive once more.

“Developers just won’t develop if it means they won’t make money,” said Alice Maloney, a director a planning consultancy Ratio Consultants. “Only the high-end, luxury developments are stacking up financially at the moment.”

Which helps explain why all the new release tend to be at the super high of prices.

A number of factors make the imbalance in pricing between new and old apartments worse in Victoria than other states. These include the government’s better apartment design standards, which set minimum sizes and design standards in 2017 and were updated in 2021. Rising land taxes and compliance costs in the private rental market to increase the quality of accommodation for renters were also prompting investors in Melbourne to sell, increasing the pool of apartments for sale, real estate agents say.

When interest rates start falling – or when people have confidence about when they will decline – established prices will also pick up and more new development will begin, they said.

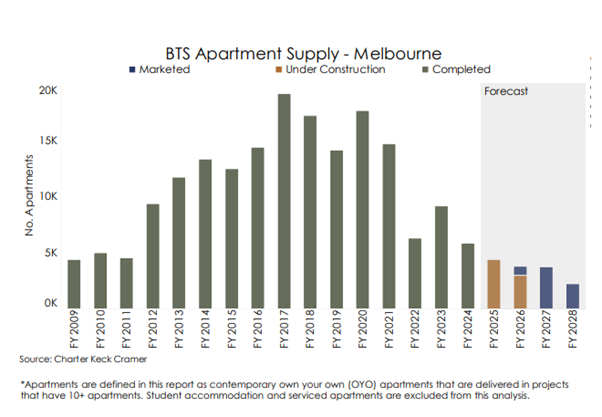

MELBOURNE SUPPLY

Apartment completions in Melbourne are very low by historic standards. At approximately 5,900 units, new apartment supply was at its lowest level for 13 years. New apartment supply is expected to fall further over the coming years, with just 4,000 apartments per annum currently projected by Charter Keck Cramer to be delivered for the next three years. This will be the lowest period of new supply recorded in Melbourne since 2009.

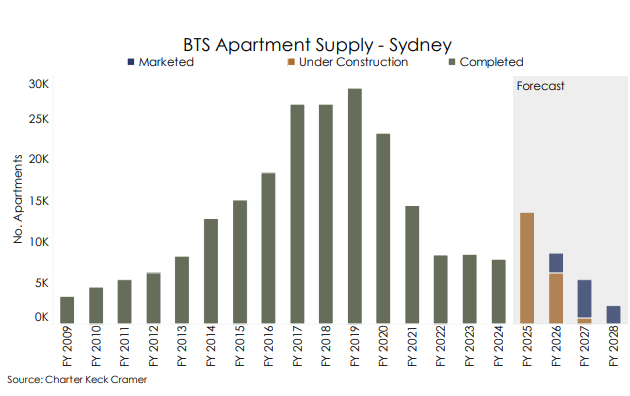

SYDNEY SUPPLY

Apartment completions in Sydney were historically low in 2024. At only 7,800 completions, new apartment supply was considerably below its historic average for the third consecutive year and the lowest for 12 years. Despite the projected uptick in supply in 2025, Charter Keck Cramer’s view is that the market will remain chronically under-supplied due to subdued completions over recent years and, looking forward, the growing population will absorb new supply more quickly than it can be built.

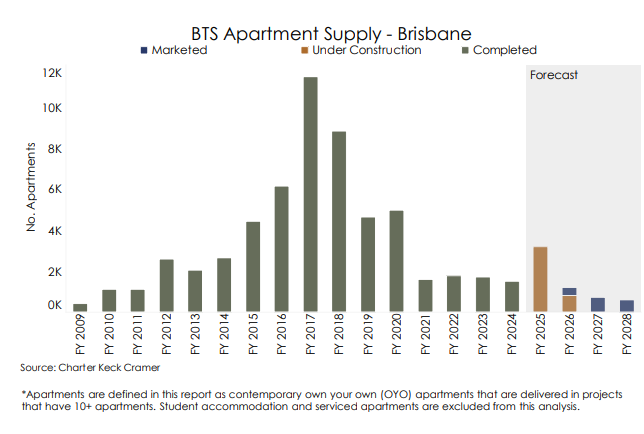

BRISBANE SUPPLY

Apartment completions in Brisbane are extremely low by historic standards. At just 1,540 completions, new apartment supply represented just a third of typical annual completions. Supply is expected to increase over the next 12 months, with 3,200 apartments under construction and due for 2025. Notwithstanding the expected 2025 increase, Charter Keck Cramer’s view is that the market will remain chronically under-supplied. Overall, the new apartment supply over the next 2-3 years is expected to remain very low.

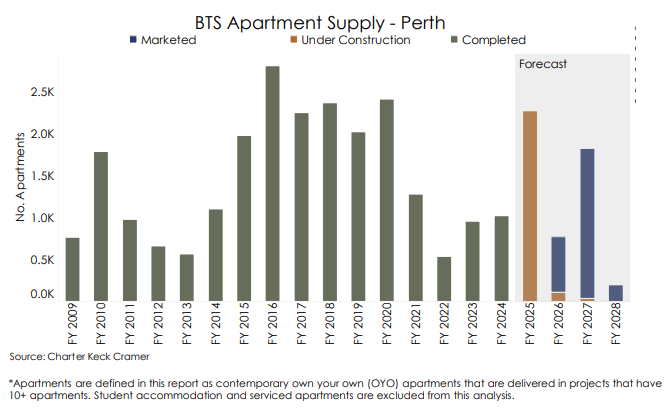

PERTH SUPPLY

For the fourth consecutive year, apartment completions were below average in Perth, reaching just 1,000 completions in 2024. Supply is expected to see a significant rebound over the next 12 months, with 2,300 apartments under construction and due for 2025 completion. Despite the projected uptick in supply for 2025 and 2026, Charter Keck Cramer’s view is that the Perth apartment market will remain under-supplied.

To obtain the detailed report on apartment supply for any of these cities , please email me michael@citylifeproperty.com with your preferred city in the subject line. I will email you the full report.

Australian Property: 2024 Year in Review And Prospects for 2025

Mike Bentley

EXECUTIVE SUMMARY

The Australian housing market showed surprising resilience in 2024, despite shifting economic conditions.

Strong Start: Early 2024 saw robust housing demand, with monthly value increases averaging 0.8% in the first quarter and higher-than-average sales volumes.

Market Performance: National sales reached 527,688 by November, up 10.4% from 2023 and 9.3% above the five-year average.

Housing values across the five major capitals rose 5.2% over the year, bringing the total value of Australian homes to over $11 trillion.

Challenges for Buyers: Rising housing values and increased costs for essentials made it harder for buyers to save for deposits and transaction costs.

Inflation and Interest Rates: Inflation crept up slightly, but interest rates likely peaked, suggesting consumer confidence may improve and support future market growth.

Shifting Trends: While early momentum was strong, demand slowed later in the year due to rising supply, affordability constraints, and inflation concerns. By December, five of eight capitals (Melbourne, Sydney, Hobart, Darwin, and Canberra) were experiencing value declines on a monthly basis.

In summary, 2024 started strong but softened as the year progressed, reflecting broader economic pressures and changing market conditions.

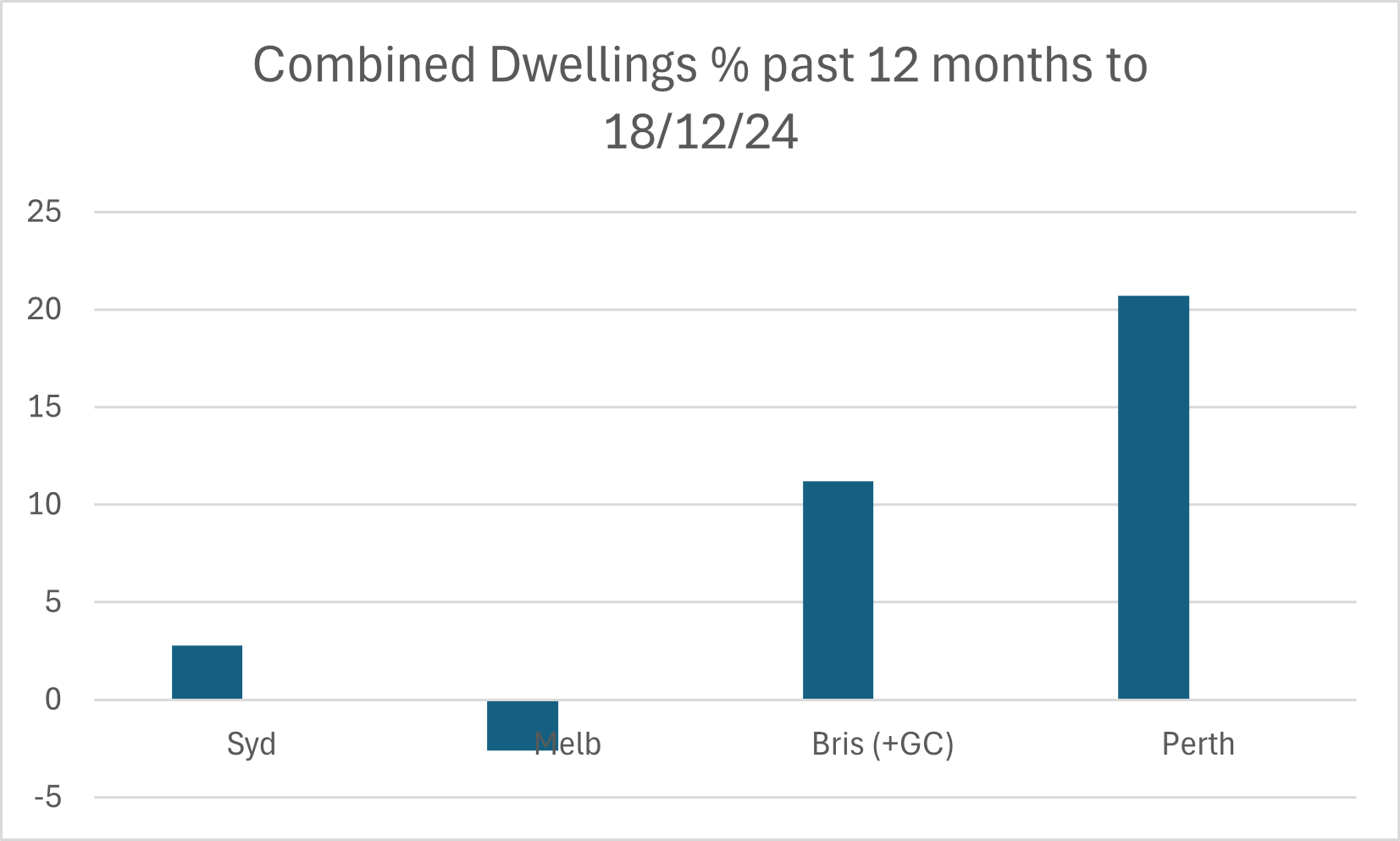

(Combined Dwellings includes Houses, Units and Townhouses. Brisbane includes Gold Coast)

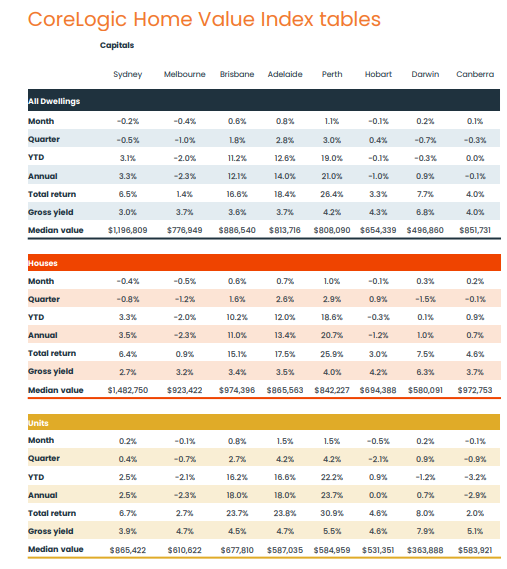

Perth has been the standout performer across all dwellings. Here below are annual increases and rental yields for all cities, over the past month, quarter and year, broken down between all dwellings combined,houses and apartments released by Core Logic on 2 December 2024:

To me, this is what is remarkable by these figures:

1. Melbourne house prices, always second only to Sydney in price, has dropped behind all cities except Hobart and Darwin.

2. Melbourne apartments are now priced below Brisbane apartments.

3. The differential between house prices and apartments in most cities has escalated greatly in the past few years, and may be at a two decade high.

Despite several economic challenges, various factors continue to drive buyer activity in the Australian property market.

Household Savings and Financial Trends

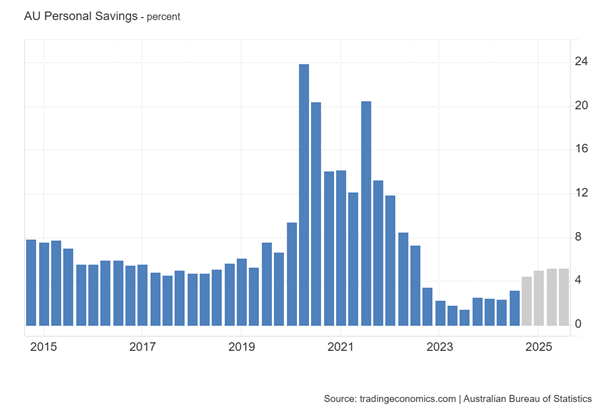

- The household savings rate rose to 3.2% in the September quarter of 2024, up from previous lows. Historically, personal savings in Australia have averaged 9.28% since 1959, with peaks during the pandemic (23.9% in Q2 2020) and lows in 2006 (-2.4%).

By the end of 2024, savings are projected to reach 4.5%, trending toward 5.9% in 2025 and 6.0% in 2026, according to Trading Economics.

Buyer Strategies

- Many buyers have adapted to higher interest rates by using larger deposits. Investors are targeting lower-value markets or apartments , minimising debt and improving loan serviceability.

- The bottom quartile of property values saw a 10.3% annual increase to November, outperforming the middle and upper market segments, where affordability issues constrained growth.

Housing Affordability Challenges

- Affordability worsened in 2024, with the median dwelling value reaching 8 times the median household income, up from 7.6 times a year earlier and matching the 2022 high. Prolonged high cash rates (4.35%) may reduce the pool of high-deposit buyers and erode affordability in previously low-value markets as demand pushes prices higher.

- New Borrowers and Credit Trends

- Investor loans: Increased by 29.5% year-on-year.

Top Growth Markets of 2024

- Houses: All top-performing suburbs were in Perth, with half having a median house value below $661,000, representing the 25th percentile nationally.

- Apartments: The top growth markets were in Perth, Brisbane, and Adelaide, with median unit values under $600,000 in the top 10 suburbs.

In summary, while affordability challenges and high cash rates pose significant barriers, strategic adjustments by buyers and growth in lower-value markets have kept the property market quite active in 2024.

CURRENT INDICATORS

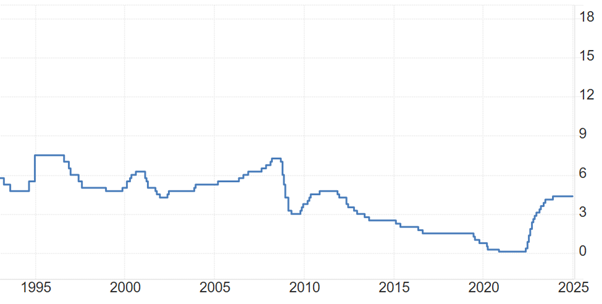

Interest Rates

While interest rates are currently the highest since 2012, it's important to put this in context. For the two decades prior to 2012, rates were consistently higher than they are today.

Future Outlook

- Economists broadly expect the first rate cut to occur around mid-2025.

- However, any reductions are likely to be modest, suggesting that current rate levels may represent a "new normal."

Implications for Property Investors

- A key comparison for investors is between rental yields and interest rates.

- In the mid-1990s, rental yields in Melbourne were 6%, matching interest rates at 6%.

- At the end of 2024, interest rates are 4.35%, roughly equal to current rental yields.

- While simplified, this comparison indicates that property investors today are in a similar position relative to 20 -39 years ago—neither significantly worse nor better off.

This alignment between rental yields and interest rates underscores the stability of investment conditions despite perceived rate challenges.

(Mortgage rates of course are higher than the Reserve Banks cash rates shown here)

There is enough comment on interest rates, and everyone has an opinion, so there is no need for me to elaborate further on them here.

New Listings for Sale

In the three months to November 2024, 139,000 new 'for sale' listings were recorded nationally—the highest for this period since 2018. This rise in advertised housing supply comes despite shrinking buyer demand, likely due to challenging economic conditions and a robust spring selling season.

Why Vendor Activity Has Increased

- The increase in listings may reflect a "catch-up" from low vendor activity during the pandemic.

- Rising interest rates and cost-of-living pressures are prompting some homeowners to sell as household finances tighten.

- Some investors are now unloading. In Brisbane because of strong gains recently, and in Melbourne because of increased taxes on investors.

Market Trends

- Time to Sell: The median selling time increased to 32 days, up from 27 days in 2023.

- Market Inventory: As of November, there were 272,645 properties for sale nationally, with 30% being new listings. Among older listings:

- 39% remained unsold for over six months.

- 21% were unsold for 3–6 months.

These trends indicate a buyer’s market, despite high property prices. Sellers should seek professional guidance to avoid joining the 60% of listings unsold after three months. Conversely, buyers can benefit from using an experienced buyer’s agent to secure better deals and outcompete others.

Clearance Rates

The combined capital cities' clearance rate averaged 57.9% in the four weeks to November 17, down from 64.1% year-to-date, reflecting softer demand and increased sellers.

More Bad News for Renters

While rental demand softened slightly in 2024, tenants still face significant challenges:

Key Factors

Shared Housing:

Rising rentals and living costs are driving more households to share or live multi-generationally, increasing average household sizes in capital cities, as noted by the RBA. Investor Activity: An increase in investor purchases has boosted rental supply, easing some pressure on rents.

Investors Selling: But this is being offset by many investors selling to owner occupiers.

Very Tough for Tenants: Throughout the country, make no mistake, it is really, really tough for tenants, except at the high end of the market. Rental Growth Trends Annual rental growth slowed to 5.3% in the year to November, down from 8.1% in 2023 and a peak of 9.6% in 2022. However, rent levels remain high, with recent increases unmatched in decades.

Vacancy Rates

Rental vacancies remain critically low, with the past two years marking the lowest rates for nearly 20 years, since 2006.

In summary, while renters experienced some relief from slower growth, overall rental conditions remain tight, and affordability challenges persist.

Key Points on Australia's Housing Supply Shortage

Chronic Undersupply: Low housing inventory has been an ongoing issue since 2008, with various contributing factors including underbuilding, population growth, and demographic shifts. The construction cranes seen around the cities over the past decade are all but gone.

Impact of COVID-19: The pandemic prompted a mass migration and remote work trends, leading to increased demand for homes, further exacerbating the shortage.

Golden Handcuff Effect: Homeowners holding low mortgage rates are hesitant to sell or trade up, which limits the availability of homes for sale.

Price Increases: Rapid price hikes over the last five years have made it more difficult for potential buyers to enter the market, contributing to a lack of inventory.

Construction Challenges: The residential construction sector faces hurdles like rising material and labour costs, though the rate of increase has slowed since the pandemic. Competition from public sector infrastructure projects continues to keep costs high.

Long-Term Issue: The housing supply shortage is a long-term problem with no immediate solutions. This issue is compounded by high population growth since international borders reopened.

Potential Policy Solutions: In 2025, there may be new government policies aimed at stimulating residential construction to try to address the ongoing housing supply shortage.

I It has become a massive priority for the Government. However, no matter what they try to do, there is no instant fix to what has been building over decades.

TIP: Kids studying? Planning on moving/retuning to Australia in the next 3 to 5 years?

The shortage is not going away, and competition for homes and units will only increase over the next few years. It is likely the biggest choice, the most stock we will see for years will be in early to mid 2025, before interest rates start to come down.

Luxury Markets

Australia's Luxury Housing Market: Resilience and Growth

The luxury and ultra-luxury real estate markets operate distinctly from more moderately priced segments, driven by unique buyer behaviours and financial factors. High-net-worth individuals, who dominate these markets, are less sensitive to interest rates, with approximately 45% of luxury homes purchased outright in cash.

Wealth accumulation, bolstered by strong stock market performance, has further amplified their purchasing power. Financing options such as margin loans, portfolio loans, and private bank loans also provide additional flexibility for this segment.

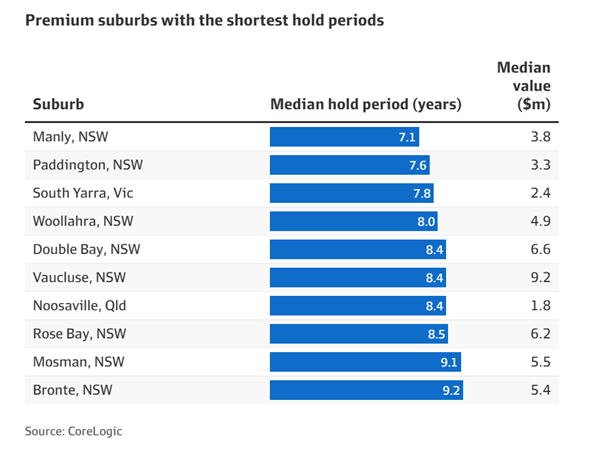

Short-Term Resale Gains and Market Dynamics

Bader Naaman, CBRE’s NSW Head of Prestige Valuation, highlights the active nature of the prestige housing market. Sellers are increasingly motivated by opportunities for short-term capital gains.

“There’s a chronic undersupply of premium properties and a strong buyer pool in this segment,” Naaman said. “This drives frequent resales, often within just a few years.”

Unlike average homebuyers, who typically hold properties for 10–15 years, prestige homeowners often seek upgrades and are frequently approached with lucrative offers to sell.

For example, a five-bedroom house at 4 Fisher Avenue in Vaucluse, Sydney, sold for $37 million in June 2023, more than doubling its 2018 purchase price of $16 million.

Scarcity and Long-Term Value

The scarcity of land in Australia’s most coveted locations is a significant factor underpinning the resilience of the luxury market. Tim Lawless, CoreLogic’s Research Director, explains:

“Desirable inner-city areas and waterfront properties have a finite supply, and this scarcity can’t be significantly alleviated by new development,” he said. “When demand consistently outstrips supply, high-end housing prices receive long-term support. The lack of newly built alternatives ensures that well-located, existing properties continue to attract substantial interest.”

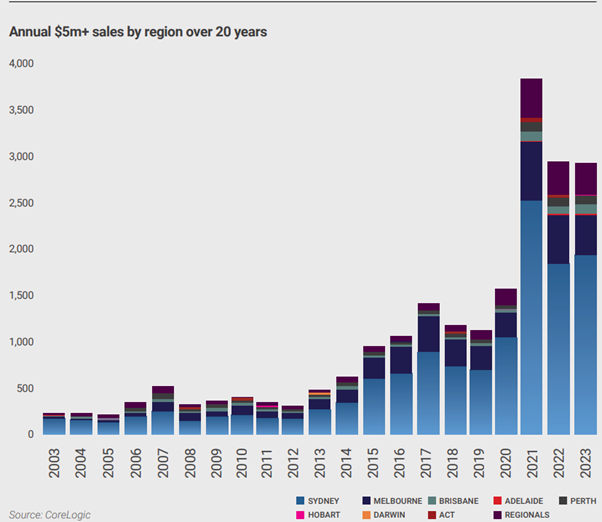

Sydney: The Epicentre of Luxury Sales

Sydney dominates Australia’s luxury housing market, accounting for nearly two-thirds of property sales exceeding $5 million in 2023. Within Sydney, the Woollahra Local Government Area contributed 22% of these transactions, with high-demand suburbs like Paddington, Double Bay, and Rose Bay leading the charge.

Properties in these areas change hands more frequently, with average holding periods as short as 8.5 years, reflecting the dynamic nature of this segment.

Outlook for the Prestige Market

The combination of scarcity, strong buyer interest, and wealth accumulation ensures that Australia’s luxury housing market remains resilient. While affordability challenges may weigh on broader market segments, the prestige market thrives on its exclusivity, attracting buyers willing to pay a premium for prime locations and exceptional properties.

Australia’s Luxury Property Market: A Snapshot

The number of homes sold for over $5 million surged by 240% between 2019 and 2021, with even steeper increases for higher price brackets. However, this extraordinary growth levelled off in 2023.

According to CoreLogic, the year ending 31 December 2023 recorded 2,927 sales at $5 million or more, representing a 0.5% decrease compared to 2022 and a 23.9% decline from the 2021 peak, which saw a record 3,845 transactions in this price range.

Waterfront Properties Lead the Market

Australia’s prestige and ultra-luxury housing markets remain geographically concentrated, particularly in waterfront locations. Sydney dominated the top 30 suburbs by transaction volume, with 23 situated along the water. Melbourne contributed six suburbs, while Noosaville, on Queensland’s Sunshine Coast, was the sole regional market represented. Mosman, on Sydney’s lower north shore, led the nation with 140 sales of $5 million or more.

This volume is attributed to Mosman’s large housing stock—it ranks as Sydney’s fifth-largest suburb by the number of dwellings—and the high value of its harbourfront properties. The combination of substantial size and proximity to Sydney’s waterfront ensures Mosman remains a cornerstone of Australia’s luxury housing market.

Australian Property Outlook for 2025

The Australian property market faces a mix of challenges and opportunities in 2025, with several factors likely to influence performance throughout the year: Inflation Control: While inflation is expected to come under control, it may remain higher than the RBA’s ideal target for a while.

Interest Rates: Interest rates are anticipated to eventually fall, but not drastically. The psychological impact of any rate cuts, following years of increases, may stimulate buyer and investor confidence.

Dwelling Scarcity: The ongoing shortage of properties available for purchase and rent is likely to persist. The shortage of dwellings available for both purchase and rent will remain a defining feature of the property market in 2025. This scarcity is driven by several factors, including limited new housing supply, zoning restrictions, and longer development timelines.

While construction activity may increase, the pace will not be enough to meet the growing demand. The gap between housing demand and supply is very concerning, and will continue to drive competition for available properties, especially in key markets such as Sydney, Melbourne, and Brisbane.

This ongoing scarcity will support property prices and put pressure on the rental market, keeping both purchase prices and rents elevated.

Rising Rents: Rent prices are expected to continue increasing until they reach unsustainable levels. Even if interest rates are cut, the rental market’s dynamics will not change significantly in the short term. As a result, renters will face ongoing cost pressures, and the affordability of rent will continue to be a major concern. However, as rents approach unsustainable levels, many tenants may be forced to opt for shared housing or multi-generational living arrangements to reduce costs.

Demographics and Population Growth: Strong population growth, driven by both natural factors and migration, will continue to fuel housing demand. Australia's relatively high immigration rates, particularly post-pandemic, are expected to continue, with skilled workers, students, and professionals seeking to settle in major cities. This influx of people will further increase the demand for housing, especially in areas with strong job opportunities, infrastructure, and amenities.

T

T

The combination of a growing population and limited housing supply will put pressure on both the property and rental markets, ensuring that demand remains high.

Market Fragmentation: Property markets will become more state-specific, with varying conditions across different regions.

While cities like Sydney and Melbourne will continue to dominate the high-end property market, other regions may experience unique market dynamics based on local economic conditions, population growth, and housing supply.

Investors Return: Investors are expected to make a strong comeback in the property market in 2025, with investor finance up nearly 30% over the last year.

This is likely due to a combination of factors, including higher rents, increasing property values, and the return of confidence as interest rates stabilize. Investors, particularly those with cash reserves, will continue to see property as a safe haven for their wealth, particularly with low deposit requirements and tax advantages such as negative gearing.

This resurgence of investors will help support property prices and could push prices up in cities with low unit prices.

Economic Resilience: Australia’s economy will remain robust, with continued employment growth despite a slight rise in unemployment.

The continued economic resilience will help bolster consumer confidence, contributing to a stable property market. Additionally, wage growth and rising employment levels will increase the affordability of housing for some buyers.

The Opportunity?

Despite the uncertainty, there is no doubt that the first 6 months of 2025 presents a "unique window of opportunity" for buyers before a market reset occurs, influenced by lower interest rates. The first half of the year could see a slight decline in national home values, making it a buyers market, with a likely rebound in the latter half of 2025, as the effects of interest rate cuts take hold.

Affordability Challenges: Affordability will remain a significant issue. Even with a potential reduction in interest rates, the median purchase price remains far beyond what’s affordable for typical buyers. CoreLogic estimates that a dwelling affordable to the median-income household is about $507,000, far less than the current median of $813,000. A rate reduction might bring this closer to $581,000, but affordability constraints are expected to continue limiting the market for first-time buyers and those needing low deposits.

Impact on Market Segments: As a result of these affordability challenges, low-deposit buyers may struggle to enter the market, while more affordable segments, like apartments, could outperform in 2025. The Council of Financial Regulators, especially APRA, will likely remain cautious about excessive credit growth, maintaining stringent serviceability buffers for new home lending.

Impact of Regulatory Measures: The Council of Financial Regulators, particularly the Australian Prudential Regulation Authority (APRA), will likely continue to monitor credit growth closely. If interest rates are lowered, there may be increased scrutiny on lending standards to prevent excessive borrowing. APRA’s three-percentage-point serviceability buffer on home loans is expected to remain in place to ensure borrowers can handle potential rate increases in the future, further limiting the purchasing power of buyers.

While this is seen as a negative for buyers, and for capital growth generally, it does have the benefit of greatly limiting the chance of a property crash, protecting the market.

Australian Rental Market Outlook for 2025: Tenants and Investors

For Tenants: The sharp rental increases witnessed between 2022 and early 2024 are likely to ease in 2025, offering some relief to tenants. The slowdown in rent growth seen in late 2024 is expected to continue into 2025, as the rapid increases driven by low supply and high demand begin to stabilise.

However, rent levels will still remain high due to the ongoing shortage of rental properties and rising population growth, particularly in major cities. Despite this, affordability challenges will persist for tenants.

The high cost of living and potential increases in unemployment could further strain household budgets, especially for younger and lower-skilled workers who are more likely to rent. As these households are more vulnerable to job losses or reduced hours, any economic slowdown could disproportionately affect them.

However, there are some positive factors that could support renters in 2025. Wages growth, although slowing, is expected to remain above the pre-COVID average, with a 3.5% increase in the year to September. Additionally, real household income has been boosted by Stage 3 tax cuts, which could provide tenants with more disposable income, although much of this boost is likely being saved rather than spent.

For Investors: While tenants may experience a slowdown in rental growth, the outlook for investors in 2025 remains relatively strong. Due to the ongoing shortage of rental properties and the high demand driven by population growth, full rental occupancy is expected to continue across most markets. This tight supply, combined with strong demand, will ensure that investors can maintain high occupancy rates for their rental properties.

A

A

Although rental price growth is likely to moderate, rental yields should remain stable, providing investors with a reliable income stream.

However, with the possibility of a slight economic slowdown and rising unemployment, some investors may need to be cautious about the stability of tenants' ability to pay rent, especially in more vulnerable sectors of the rental market. Prime, affluent locations remain the best bet for apartment investors. In summary, the Australian rental market in 2025 will present mixed conditions for tenants and investors. Tenants may see some relief in terms of slowing rent increases, but affordability will remain a challenge.

On the other hand, investors can expect continued strong demand and high rental occupancy rates, even though rental growth may not be as rapid as in recent years.

2025 TIPS

-Melbourne: As consumer sentiment rises, Melbourne is expected to benefit from improved affordability, particularly in areas where prices have softened since 2022. With fewer new listings and a constrained supply, the city may see a rise in property values, especially in desirable locations.

-Perth and Adelaide: While these markets have experienced strong price growth due to a demand shock, that trend may start to ease in 2025. However, they could still provide solid investment opportunities, especially if buyers can identify areas with sustained demand.

-Subdued New Housing Construction: With construction activity remaining low across the country, there is likely to be continued support for housing values due to a lack of new supply. Areas with strong demand and limited new housing are expected to perform well.

-Uncertainty and Geopolitical Risks: While uncertainty around global and domestic factors (such as geopolitical issues and housing policy changes ahead of the federal election) may create volatility, the overall outlook suggests that well-located, desirable properties, especially in cities and regions with strong demand, will remain solid investments in 2025.

-Apartment buyers should focus on Melbourne in 2025 and 2026. There are bargains to be found with high rental returns, in some cases around 6%, and full rental occupancy, with significant upside potential after years in the doldrums. But careful selection is critical, to avoid a stagnating property during the forthcoming upturn.

Conclusion

In summary, 2025 will be a year of mixed market conditions, with fragmented performance across regions, rising rents, and a continuation of affordability pressures. However, there is an opportunity for buyers before a market reset.

While the window of opportunity created by rate cuts may offer a short-term boost, affordability constraints will remain a significant challenge, especially for first-time buyers. Affluent buyers have the opposite problem. High demand and strong prices, with limited supply.

The ongoing shortage of housing, strong population growth, and increasing investor activity will continue to fuel demand, but market performance will likely vary by state and region.

B

B

Buyers and investors will need to navigate these challenges carefully.

If you want a unit in Sydney or Melbourne, at the best possible price, or even for off-market properties not listed on real estate websites, contact me for tips and strategies!

For those wanting to sell, careful selection of their selling agent is critical to avoid a long period on the market. Contact me for advice in how to find the BEST agent for YOUR property. And NO, it is NOT your property manager!

For those who own student housing, contact me if you want to sell, now is the best time in two decades to sell, as the high rental returns are finally attracting investors.

Contact Mike on email michael@citylifeproperty.com; WhatsApp 852 9031 9669; Tel 61 468 314 999

SELL WITH CONFIDENCEE, FREE SELLERS GUIDE TO GETTING THE HIGHEST PRICE FROM AGENTS: